The Tiger Forex Report 7-10-23

The Tiger Forex Report – Week of 7/10 – 7/14/2023

DXY took one on the chin again last week. More Bearish action is on the agenda early in the week.

Crude Oil is back on the rally train. A challenge of the upside breakout level is expected.

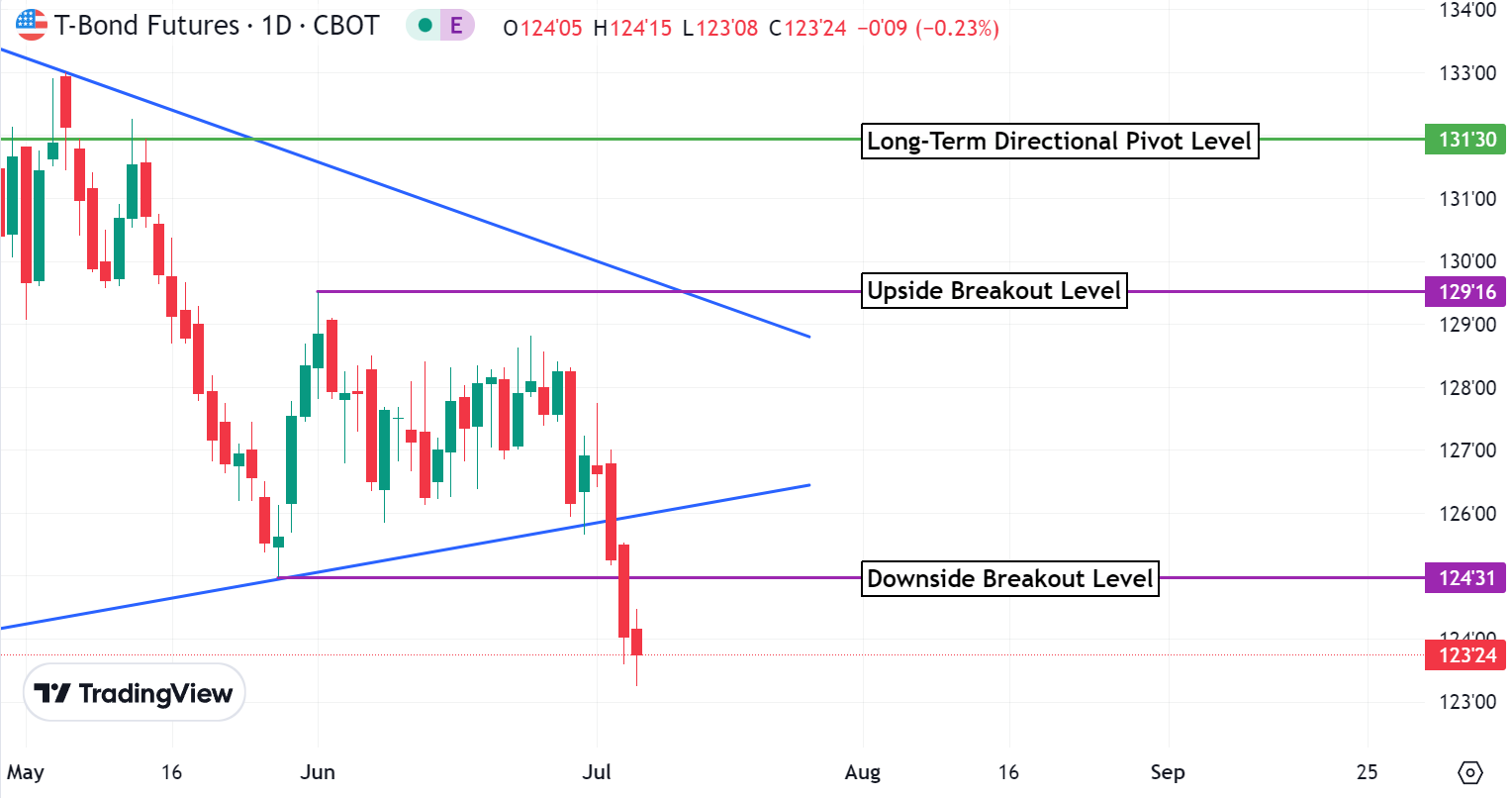

30yr T-Bonds are looking for fair value. Newer move lows are expected, but it may not give the USD much of a boost.

EURUSD Weekly Outlook:

The Bulls are looking to take the EURUSD to higher move highs. A breach of the upside breakout level is expected this week. If this occurs, there is a good chance that the market will make a run for the upside target level. That is all that is likely out of a higher trading market this week if Yields continue pressing higher.

If the USD gets a surge, then the EURUSD Bears may be able to reverse gears. With Yields up this scenario may pull back the market into a sideways trade back to the downside correction zone. The EU economy is falling apart at the seams, and the ECB is still set for a few more rate hikes. This should help put the brakes on a lower trading market. We are settling into a potential range trade environment as the ECB slows hikes, and the FED is questionable as to how much they will hike again.

GBPUSD Weekly Outlook:

Wow is this FX pair looking to press newer move highs. Last weeks rally has the GBPUSD poised for a rally above the upside breakout level. 1.2966 is the first target on a move that has the potential to reach the 1.3045 level before there is a pause. A close above 1.2851 this week would be a strong indication that this market is trying to hold a buy break posture.

GBPUSD Bears are going to have a tough time of it between the upside breakout level and the critical swing low. Trading under here will have sellers trying to press lows into the downside correction zone. Be careful at these lower levels. It is unlikely that the Bears will be able to maintain a lower moving trend. A failure and close below 1.2511 is necessary to confirm extended weakness that would be putting an end to the recent Bullish trend.

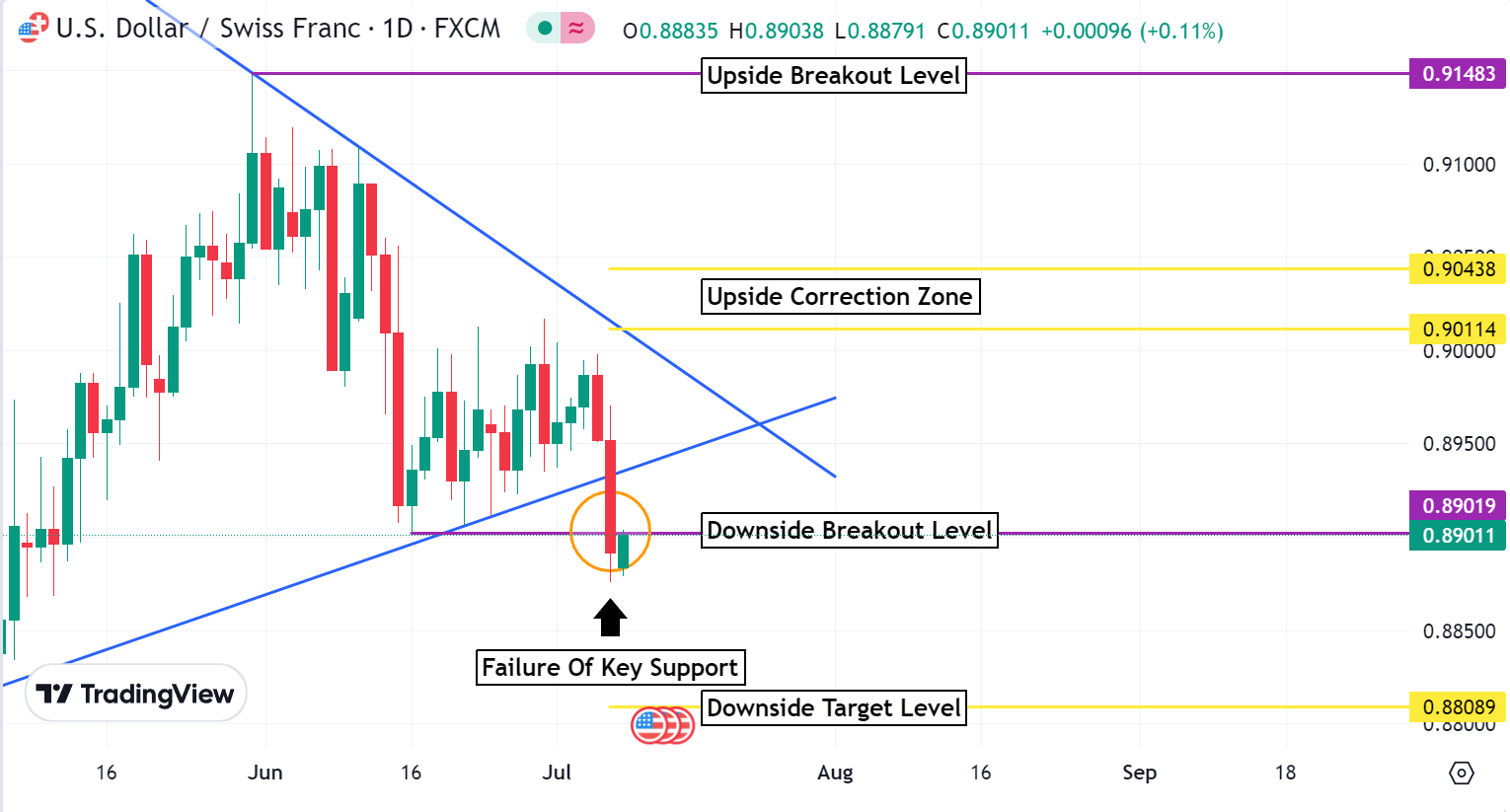

USDCHF Weekly Outlook:

The Bears fell through the downside breakout level last week. Bearish momentum is building. If the USD remains under pressure this week, then it is likely that the Bears will be on a hunt for the downside target level. Remember that the overall trend is a long-term Bear. A failure from 0.8808 would be a negative indication on the monthly basis that the USDCHF is in a free fall. 0.8622 is the extended sell off objective.

Only a sustained trade above the downside breakout level confirms enough strength for a grind of a trade towards the upside correction zone. Be careful holding longs at these higher levels. Unless there is a surge in the USD, this market is set to fall back on support. Only a close above 0.9043 would reverse this outlook.

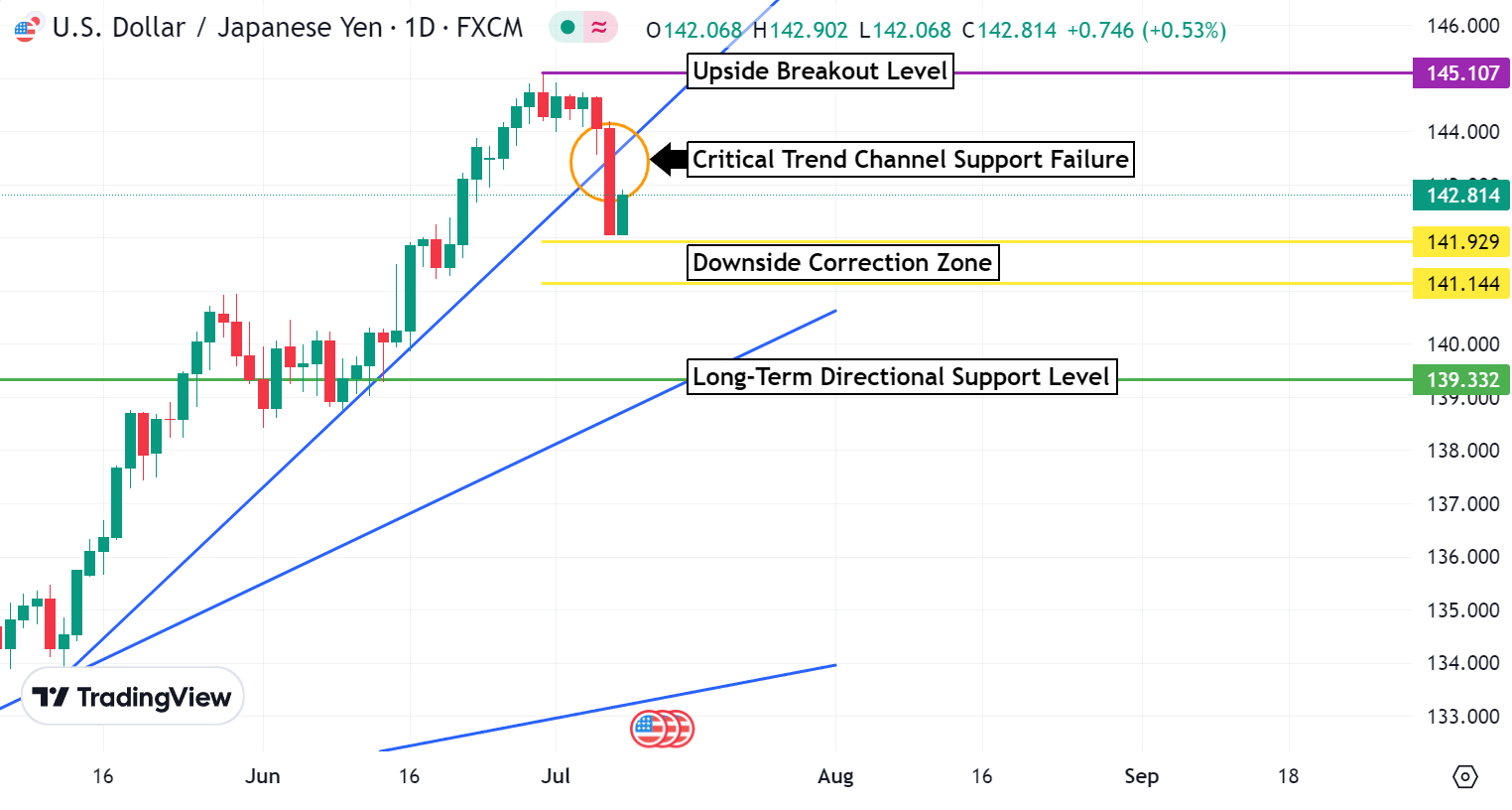

USDJPY Weekly Outlook:

There was a profit taking slide in the USDJPY last week that fell short of the downside correction zone. It is expected that the Bears will make another play for lower move lows and press support down towards the 141.144 support level. A failure from here should extend the slide down to the long-term directional support level. All lower trading is currently viewed as a corrective move until the economic fundamentals change for the JPY.

Remember that this market is in buy break mode. This market is likely to turn sharply and bring the Bulls back in a big way. The downside correction zone may be all that the current pull back can achieve. Do not fight a strong surge back up towards the upside breakout level. If the market spikes above here, then buying momentum is expected to build as weak stops are triggered, and fresh buying returns to ride the Bullish wave. Higher move highs are in the cards until a trend change is confirmed.

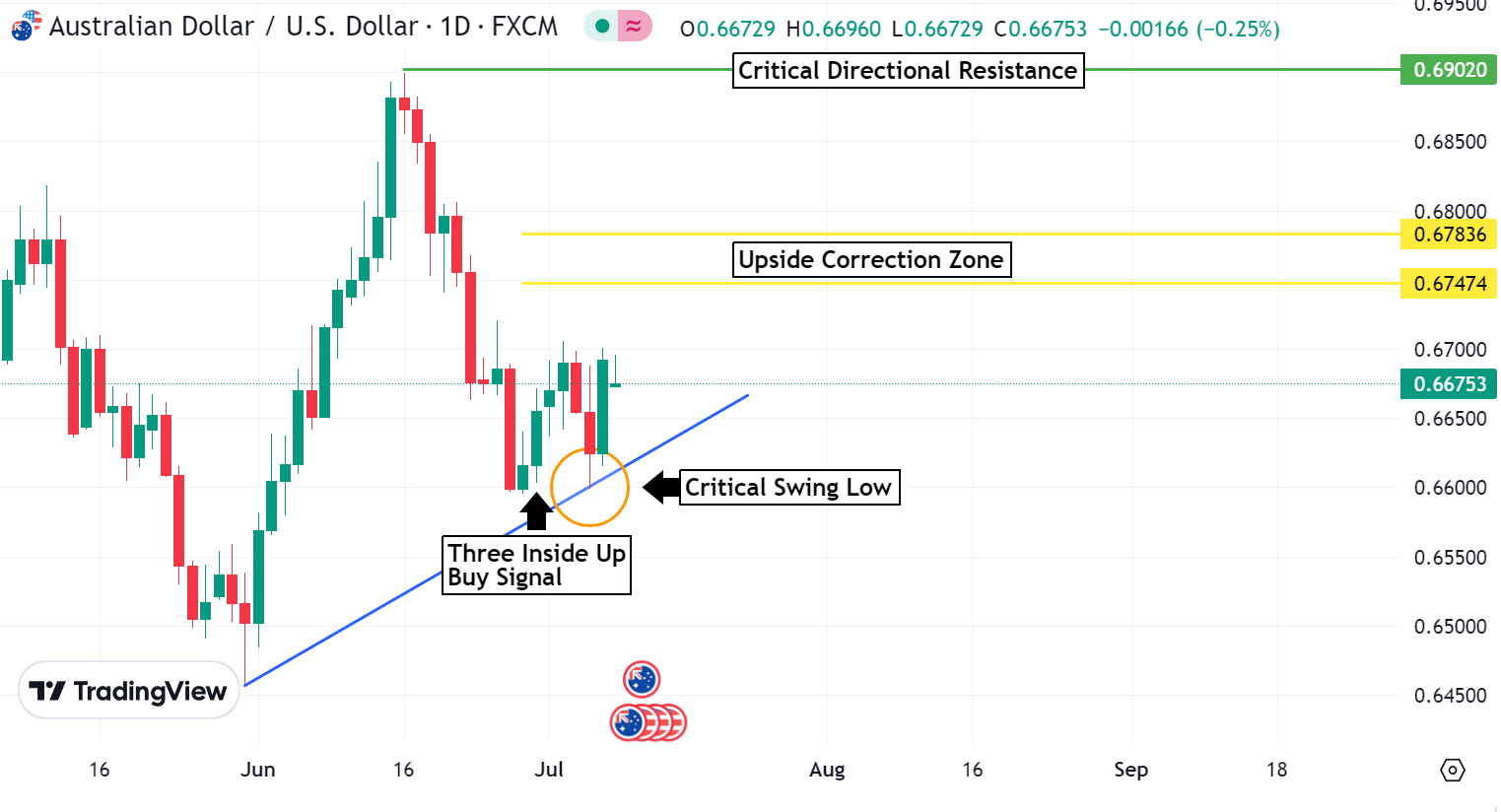

AUDUSD Weekly Outlook:

AUDUSD traders are caught in a tough trade that is trying to spark a correction. This market is ripe for a rally into the upside correction zone, but it should put a cap on a higher trading market. The fundamentals are weak for the AUD, and that makes the long-term outlook Bearish. Only a close above the 0.6783 level confirms strength for a follow through leg higher.

A dip below last week’s swing low would be a Bearish indication that the AUDUSD is set to pound new move lows. If the DXY is weak it does not mean that this currency is going to get a lift. This FX pair has the potential to hit the 0.6425 before the summer is through. If new swing lows develop, it is very likely that the Bears will really slam this market fast and hard.

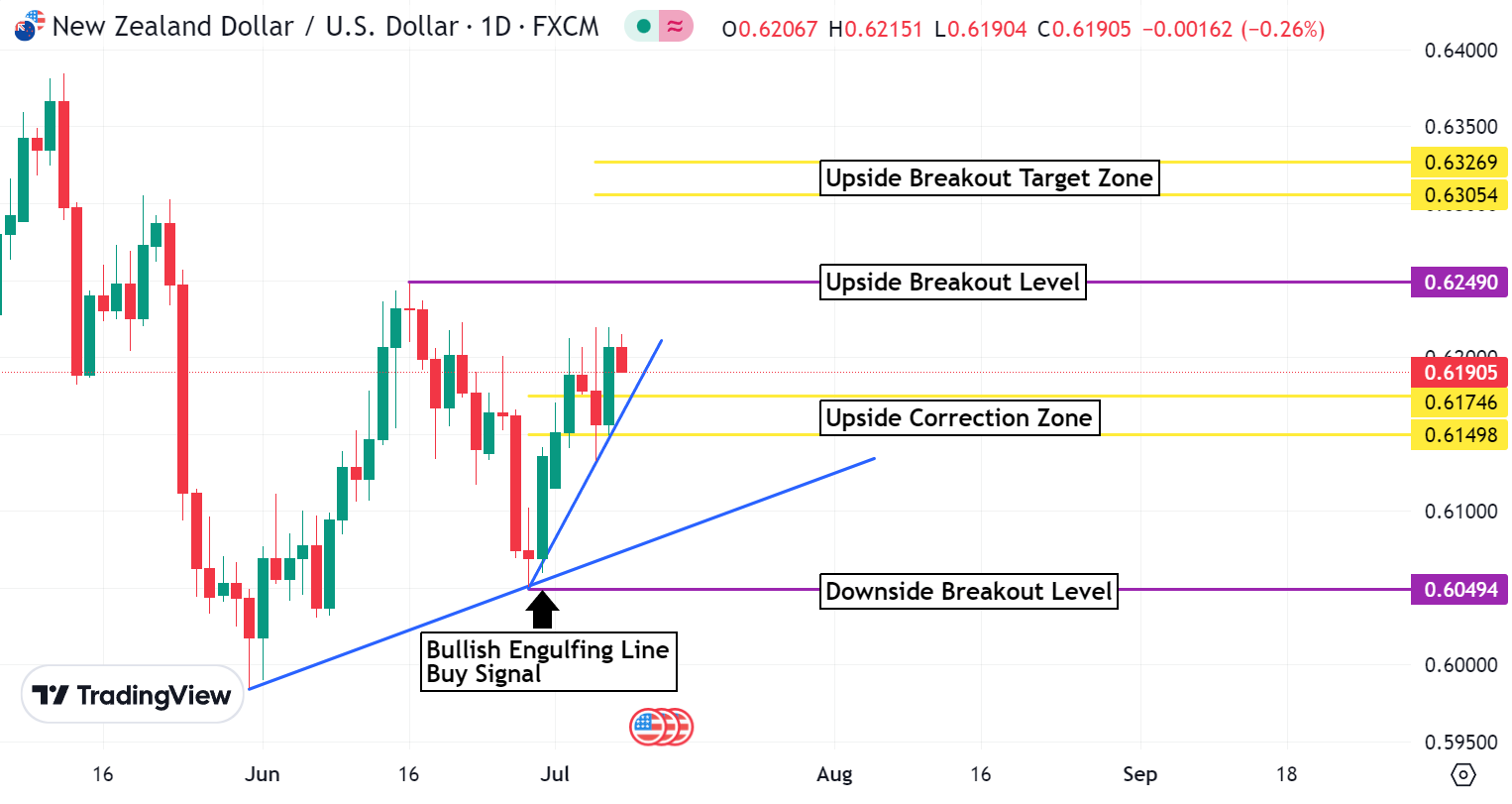

NZDUSD Weekly Outlook:

The upside correction zone has become the big pivot area for the trade moving forward. Trading above here keeps the market poised to challenge the upside breakout level. If the Bulls are really in control, the NZDUSD should be able to extend a new swing high up towards the upside breakout target zone. Remember that the New Zealand economy is a disaster, but they are joining BRICs. This may help to keep the NZDUSD Bulls going for a while. We shall see how things unfold.

Trading under 0.6149 puts the Bulls on hold as the Bears try and keep the trend down. It will be a tough trade all the way to the downside breakout level. If the NZDUSD falls under here the selling pressure is expected to get severe. 0.5875 is the first stop on a slide that may get as low as the 0.5650 level this summer. If inflation numbers start to surge again, then this scenario of hitting these lower extremes becomes very probable.

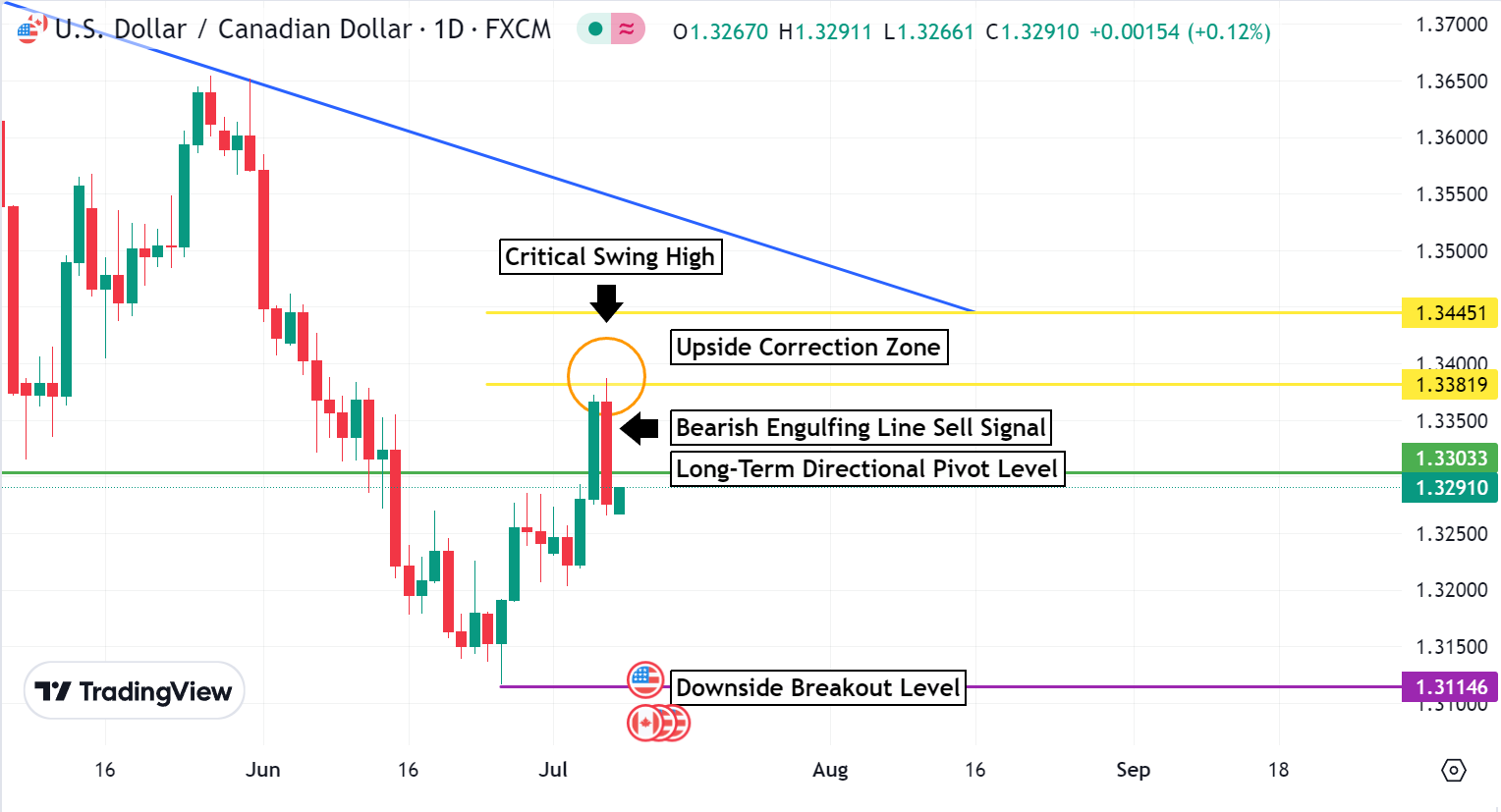

USDCAD Weekly Outlook:

The USDCAD gave us a sell signal on Friday. Key off the recent high for direction. Trading below here keeps the signal alive for a break that targets the downside breakout level. If the USD weakness is truly building, then the Bears have the potential to press new monthly lows hard. 1.3100 is the downside target. 1.2937 is the longer-term sell off target.

If the Bulls get a rally back above Friday’s high, then expect a challenge of the 1.3445 level before the week is though. This should put a lid on the Bulls for a short-term pause. Remember that this market has been in a very wide range trade for months, and it is in a short-term Bear posture. Only a close above 1.3445 confirms a reversal in trend. 1.3650 is the longer-term upside objective. With the USD under pressure in the short-term it is unlikely that the USDCAD will be able to sustain a rally up to these upper levels any time soon.