The Tiger Forex Report 7-15-24

The Tiger Forex Report – Week of 7/15 – 7/19/2024

The DXY Bears are in control, and more downside pressure is likely this week.

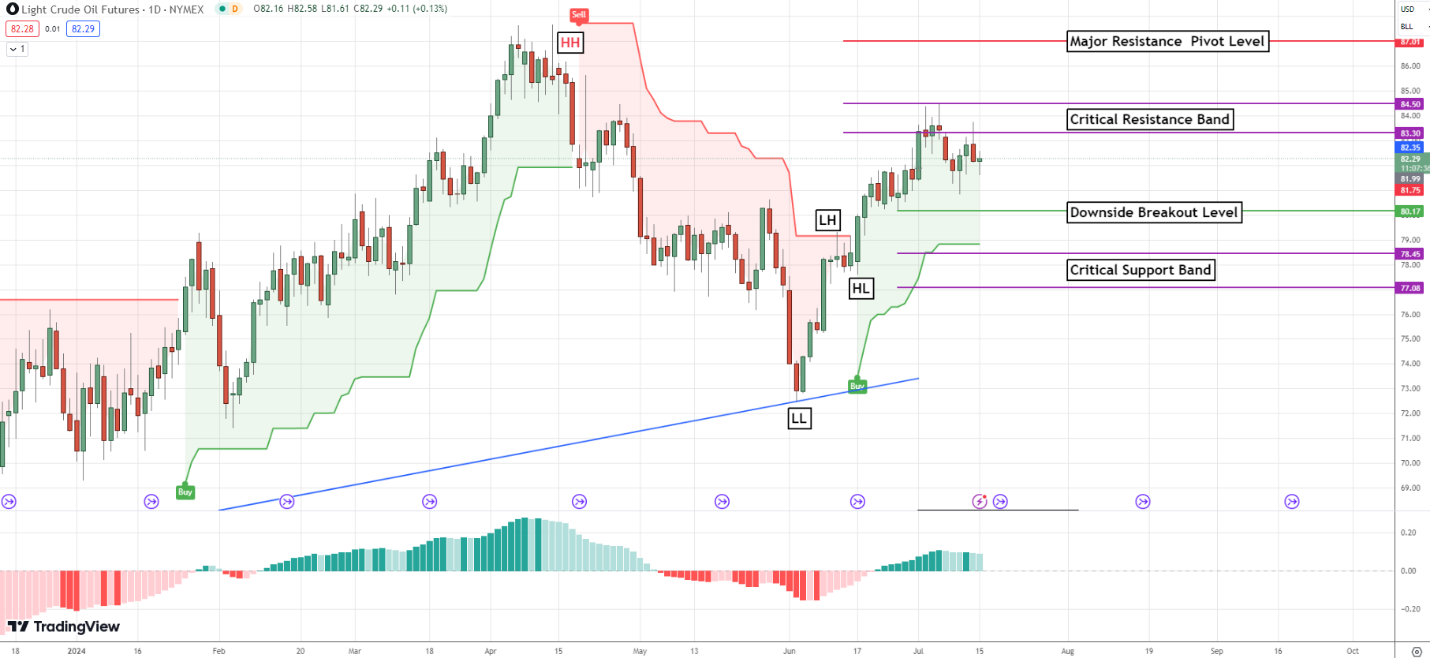

Crude Oil is settling into a range trade. More sideways is the call for a few more sessions.

30yr T-Bond Bulls are flirting with a continuation move higher. Use caution to the upside. A spike-high situation is brewing.

EURUSD Weekly Outlook:

EURUSD Bulls are flirting with newer move highs. A rally above the upside breakout level could touch off a fresh wave of buying as weak stops are expected to be triggered. The critical resistance band should put a halt to short-term Bullish momentum. This market has been in rally mode for a few weeks, and a profit-taking pullback is looming. Economic numbers have slowed in severity, but the reality is that the outlook is still bleak.

Below the upside breakout level, the market will be in a digestive trade down to the monthly directional pivot level. Only below here does the short-term outlook change to neutral as the EURUSD falls back into the range of the last few months. The downside correction band is all that is likely for a lower trading market this week.

GBPUSD Weekly Outlook:

The Pound has gone verticle, and a buy-break posture is the call for the week. Newer move highs are likely this week. 1.3050 and 1.3105 are the extended upside targets. It would be unwise to sell into this move. Wait for a valid sell signal or a pullback to buy into.

If the Bears get a grip on the GBPUSD it will most likely be a profit-taking slide. The critical profit-taking support band is expected to be the floor for a lower trading market this week. Momentum is in the hands of the Bulls and it is expected to remain so for another couple of weeks. Only a failure from 1.2758 would change the outlook and make the short-term correction band a viable extended sell-off area.

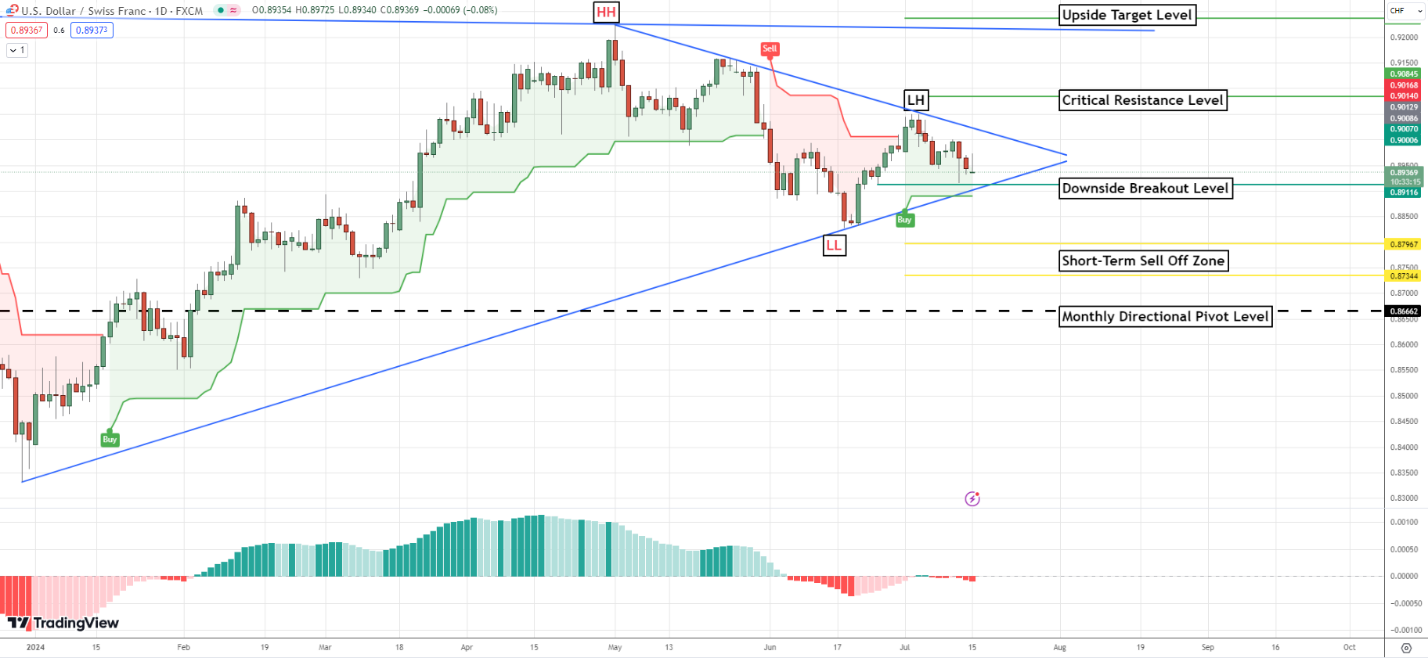

USDCHF Weekly Outlook:

USDCHF traders are having a tough time with a grinding Bearish market. A test of the downside breakout level is expected. If a sustained trade develops in this area the Bears could get a nice move going. The short-term sell-off zone is a good area for new move lows to work toward.

Between the downside breakout level and the critical resistance level, it will be a very tough range trade with little follow-through. If the Bulls can breach the critical resistance level a surge of fresh buying momentum may enter the market. A close above 0.9084 would be a good indication that the Bulls are poised to press newer move highs up to the upside target level over the next couple of weeks.

USDJPY Weekly Outlook:

Correction connection. The Bulls took one on the chin last week, and are hovering above the downside breakout level. Use this for directional bias this week. Above here the market is likely to digest recent volatility and settle into a slow grinding rally higher. New highs are not likely this week.

Below 157.15 the market will be in the chop zone grappling with direction. The critical short-term correction band is all that is likely for a lower trading market. Only a close under 152.08 would confirm a longer-term directional bias for the Bears. That would make the critical BOJ threshold level the main objective for a new trend lower.

AUDUSD Weekly Outlook:

The Bulls are in control. Key off the directional pivot level. Above here the Bulls will be in an aggressive posture aimed at the long-term upside target. This is expected to cap the current rally, and set the AUDUSD up to settle into a digestive trade. Only a close above 0.6828 would confirm any extended upside Bullish action.

Below 0.6828 the market will be in corrective mode down to the critical support level. This should hold up a lower trading market, and a bounce here is very likely. If the Bears can get a close under this level, then the likelihood of further downside action becomes viable.

NZDUSD Weekly Outlook:

NZDUSD traders are in consolidation mode. Use the critical support level for directional bias. Above here the market is in limbo up to the critical resistance band. Only a close above this area would confirm any real Bullish trend.

Under 0.6081 the Bears will be set to lean on the bullish corrective support band. This is all that is on the menu for a lower trading market this week. Use caution trying to press any Bearish trade. The NZDUSD is not likely to get much follow-through to the downside.

USDCAD Weekly Outlook:

The weak USD is not helping the USDCAD out, but it is not hurting it too bad either. This market is locked in a long-term range trade. There is only one call for this currency this week. Stay away. There is only a buck and a half of market action to play with. There is no direction or follow-through here. When we get a signal there will be an update. The temptation for intra-day traders will be high, but it is advisable to just sit back and wait for a market setup.