The Tiger Forex Report 7-17-23

The Tiger Forex Report – Week of 7/17 – 7/21/2023

The DXY may have posted a short-term critical swing low on Friday. Key off the low for direction.

Crude Oil posted a short-term sell signal on Friday. This market has had quite the run up this month, and a short-term correction may be starting.

30yr T-Bond Yields have been in retreat, but this is only being viewed as a correction.

EURUSD Weekly Outlook:

The Bulls are on a mission lately, but a short-term turn is on the menu. Key off the upside breakout level. Trading under here will have the market poised for a break that targets the downside correction zone. This is all that is likely from a turn to support. Only a failure from the downside breakout level would change the outlook, and confirm a reversal of the overall trend.

Use caution fighting a rally above the upside breakout level. A breach of this area is likely to spark fresh buying for an extended leg higher that targets the 1.1372 level. The ECB is expected to raise rates again, and this should help to keep this currency in a Bullish posture. 1.1524 is the longer-term trend objective.

GBPUSD Weekly Outlook:

The GBPUSD may be ready for a short-term correction. Trading under the upside breakout level keeps the Bears in an aggressive sell posture that targets the downside correction zone. This is all that is expected from a sell off in this currency. Only a slide below 1.2805 would confirm the markets intention to press support towards the downside breakout level.

If the Bulls get a rally above the upside breakout level it would be unwise to fight this move. Trading above 1.3144 targets the 1.3280 – 1.3294 resistance band. This should put a cap on a higher trading market in the short-term. This currency has had quite the runup over the past few weeks, and a temporary pull back is very likely.

USDCHF Weekly Outlook:

USDCHF Bears may be out of gas. Use the downside breakout level for directional bias. Trading above here sets the Bulls up for a rally that targets the upside correction zone. This is all that is expected out of a higher trading market. Only a close above 0.8925 would confirm that this FX pair is trying to reverse the overall trend.

Do not fight a slide below the downside breakout level. A failure from here is a negative signal that the USDCHF is going to press the Bear trend all the way down towards the 0.8436 level. This market is in a major sell rally mode, and this currency may see 0.8390 before there is a bounce.

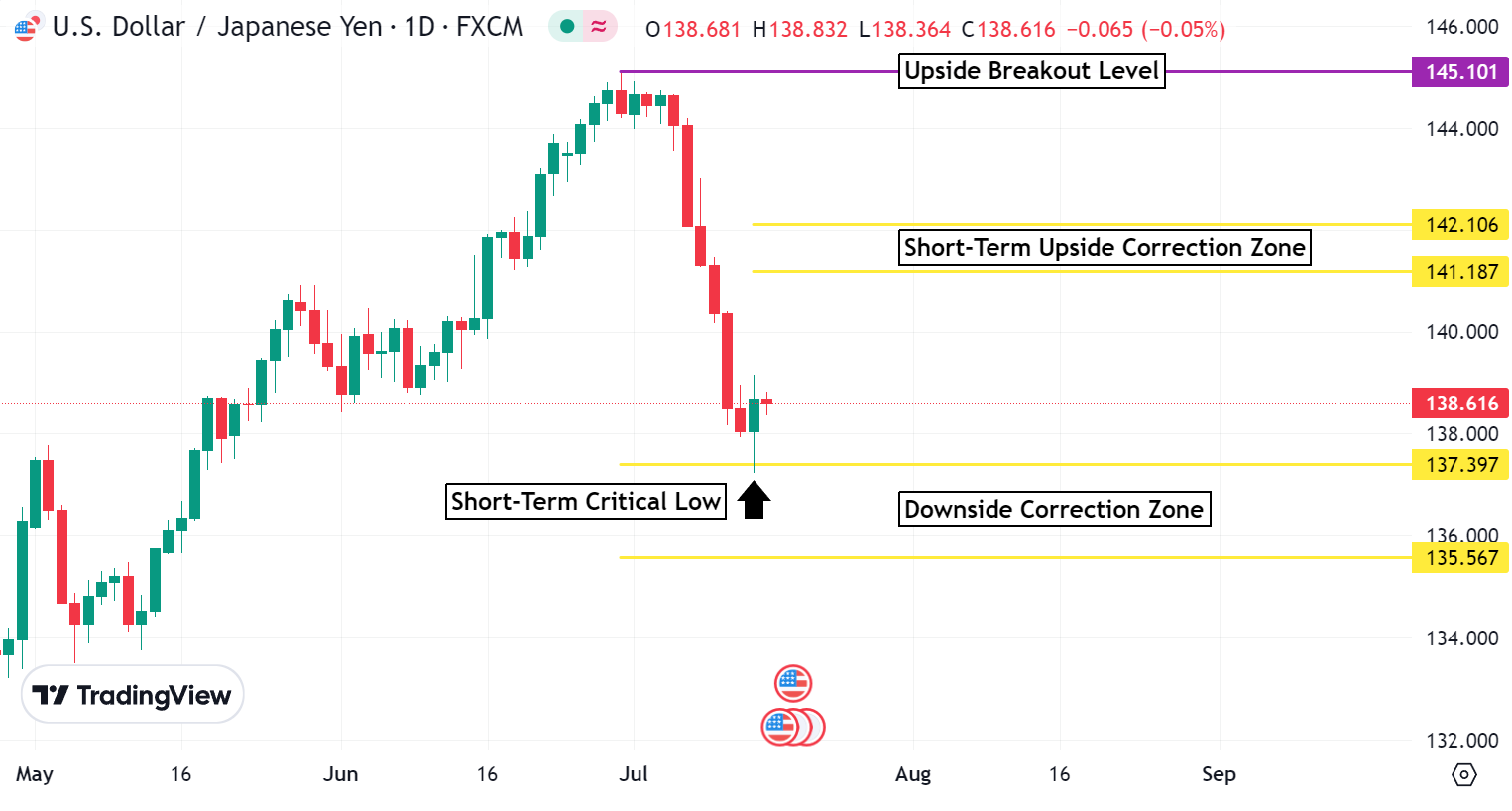

USDJPY Weekly Outlook:

A short-term critical low was set on Friday touching into the downside correction zone. Use Friday’s low for direction. Trading above here will have the Bulls poised for a rally up into the short-term upside correction zone. This is a critical area for the USDJPY. If the market gets above 142.10, then the upside breakout level becomes a very reachable target.

A failure from Friday’s low will put the market back on edge for an extended break that targets 135.56. This is a key level holding up the market. Trading under this area would be a very negative sign that this currency may slam new move lows down towards the 131.95 level before there is a bounce.

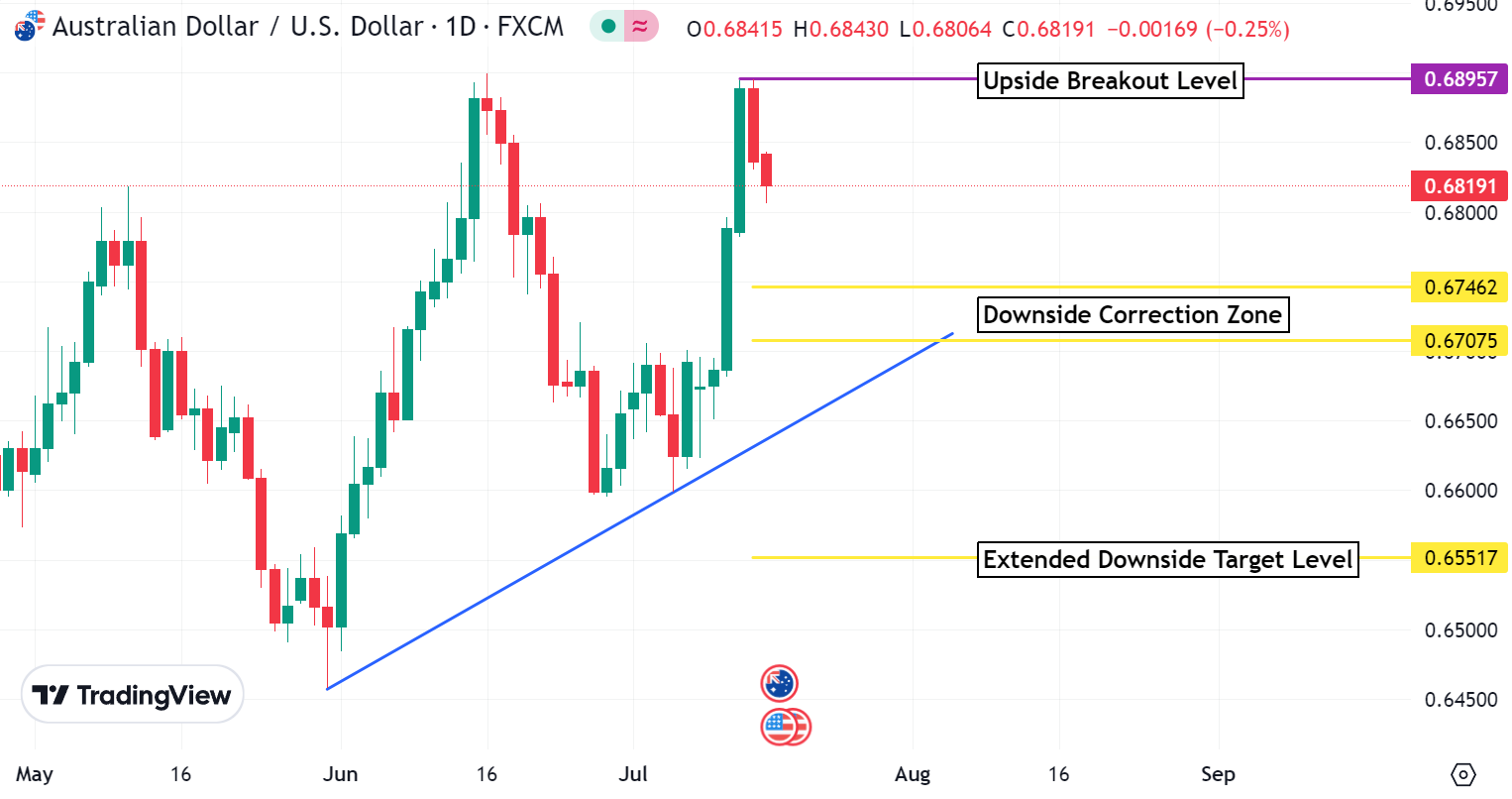

AUDUSD Weekly Outlook:

AUDUSD bears have this market in retreat mode. A test of the downside correction zone is likely. If the trend is to remain intact, this area should hold the market afloat. Trading under 0.6707 is a negative sign that the market is going to try and press support all the way down to the extended downside target level. This would also confirm a change in the long-term trend.

If the Bulls can get above the upside breakout level, then a fresh wave of buying is likely. 0.9670 is the first stop on a rally that has the potential to hit 0.9804 before there is a change in direction. A move back to these levels would also start to change the long-term trend outlook.

NZDUSD Weekly Outlook:

The NZDUSD is set to play with support for a few days. A slide back towards the long-term directional pivot level is likely. If the Bears can get below here, then the market has a good chance at pressing new move lows into the downside correction zone. This is all that is expected out of this currency this week.

If the Bulls get a print above the upside breakout level it is likely to touch off fresh buying. 0.6475 is the first stop on a rally that could see 0.6515 before there is a pull back. This FX pair has had quite a run up the last couple of months, and it would be a good idea to keep this in mind when setting your Stops for any Long positions.

USDCAD Weekly Outlook:

USDCAD Bulls sparked a fresh buy signal on Friday. Trading above 1.3212 will have this currency set for a rally that targets the 1.3461 level. This is all that is likely for a correction if the trend is to remain in a longer-term Bearish direction. Let us see how the signal works out.

Only a failure from Friday’s low negates the buy signal, and pulls the rug out from under the Bulls feet. Do not try and catch a falling knife. Trading under 1.3088 targets the 1.2857 level. The slope of the current trend is steep, and if new lows surface the slope will get even more extreme. 1.2560 is the extended longer-term trend objective.