The Tiger Forex Report 7-22-24

The Tiger Forex Report – Week of 7/22 – 7/26/2024

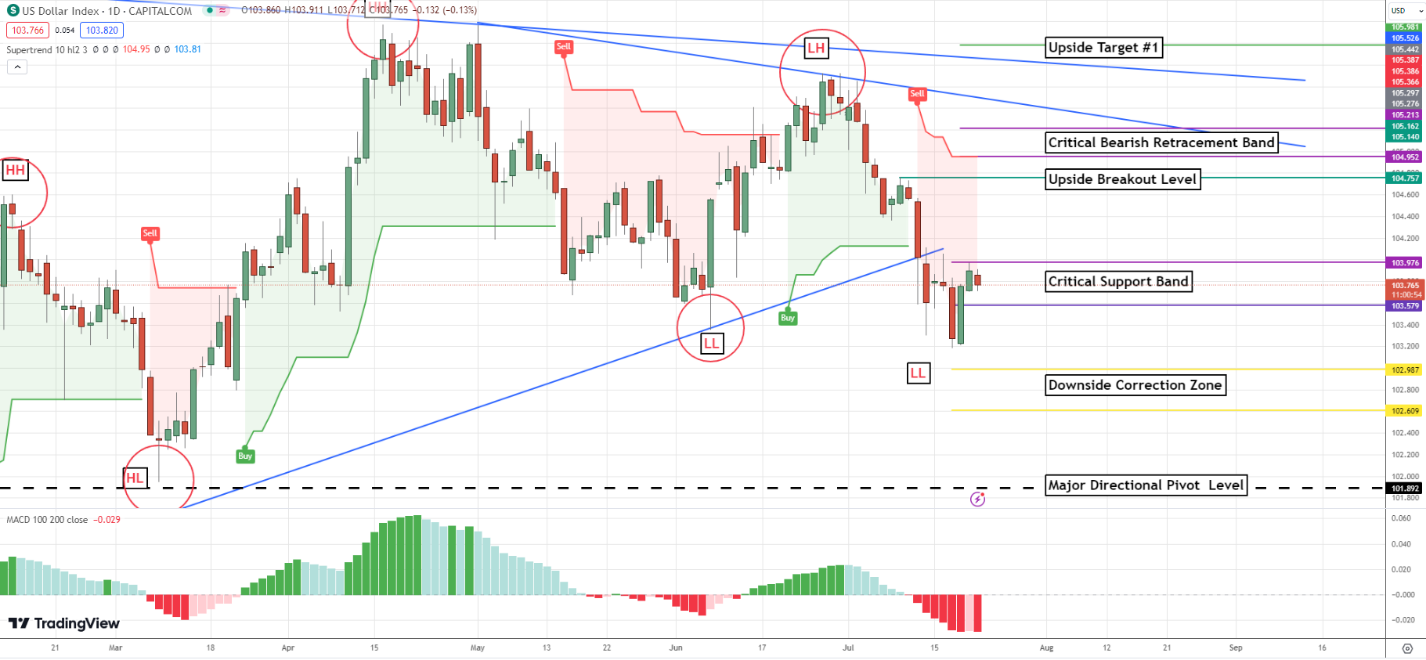

The DXY planted a newer move low, but was little changed on the week. A higher trading index is likely, but not too much Bullish action is likely.

Crude Oil Bears are on the move, and more lower trading action early in the week is on the menu.

30yr T-Bond Bulls stalled, and newer move lows are expected before the week is out.

EURUSD Weekly Outlook:

EURUSD Bulls stalled and may be ready for a corrective move. The monthly directional pivot level is the target. This will be a key area. If there is going to be a bounce this would be a good area for it to happen. If Yields start to creep higher then this becomes a very viable scenario. Although the Bears should get the lead on direction this week there is not much more planned to the downside. Do not get caught selling this market in the hole.

If the Bulls can take out last weeks high then the market should spike into the critical resistance band. Not much more is likely out of the Bulls this week. Only a major drop in Yields would justify trading above this area. 1.1045 is the extended upside objective.

GBPUSD Weekly Outlook:

GBPUSD Bulls are trying to hold the trend intact. It may be time for the Bulls to digest the recent leg higher. This FX pair remains in a buy break posture. Use Friday’s low for directional bias. Trading above here sets the Bulls up for another rally toward the recent high. If the market breaches the upside breakout level the market has a good chance at blasting through resistance all the way up to 1.3125.

A failure from last weeks low should not be discounted. New move lows are likely to drive the GBPUSD into the downside correction zone. Remember this market is in a Bull trend. Not much more is likely below the 1.2780 level. A failure from here would be a sign that the Bears have their sights on the monthly directional pivot level.

USDCHF Weekly Outlook:

This market has been a tough trade on a daily basis, and more of the same is expected. The best advice is to wait for a valid signal before getting into this market. A rally above the upside breakout level is needed to confirm a fresh Bullish leg higher. If the market gets above here then the upside target level will become the fresh Bullish trend target.

Under the upside breakout level the USDCHF will be in a choppy trade lower that is aimed at the short-term sell off zone. This is all that is likely for a lower trade, unless the DXY becomes very Bearish. If this occurs then the market will be on a mission to reach the 0.8666 level over the next couple of weeks.

USDJPY Weekly Outlook:

USDJPY traders are riding the downside breakout level. Things are expected to be choppy around this area. A sustained trade below here keeps the market locked in the chop zone. The critical short-term correction band is the lower extreme for a correction. Only a huge pull back in yields would justify lower trading action beyond here.

If the market can hold above the downside breakout level the Bulls may recapture the trend. The critical resistance band will be the hurdle to cross. Trading above this area would be a good sign that the Bulls are going to challenge the upside breakout level. 162.00 is the longer-term new move high target.

AUDUSD Weekly Outlook:

The rug has been ripped out from under the Bulls feet in this market. A test of the downside breakout level is likely to touch off fresh selling. This puts the downside correction zone on the Bears radar. Do not fight a dip below this area. Trading under here would be a negative sign that the AUDUSD will be on a mission to reach the monthly directional pivot level.

Sustained trading above the downside breakout level would be a sign that the market is back into a consolidation phase. A choppy trade is likely. The upside correction zone should cap any Bullish move this week. However, if the market gets above here it is up…up…and away. If the market gets above here this week we will have an update.

NZDUSD Weekly Outlook:

The Bears are in control of momentum and a test of the critical support band should occur. A bounce is very likely. If the Bears get below here the outlook becomes very Bearish. Big swings are expected below here, and volatility will most likely make it difficult to jump in. Trading under this area puts the monthly low from April in jeopardy.

Trading above the critical support band puts this FX pair in digestive mode. Only a violation of the upside correction band would change the outlook. A rally above this area would be a positive sign that the Bulls are retaking control of the trend. The critical resistance band is the longer-term objective.

USDCAD Weekly Outlook:

USDCAD Bulls are on the move, and the trend may continue this week. Trading above the upside resistance band keeps momentum alive, and makes the upside breakout level the next level to cross. Do not fight a rally above here. Momentum is expected to build at these levels. New monthly highs are expected above here. 1.4000 is the longer-term upside target.

If the Bulls stall this week, it will most likely be a range trade back to the critical support band. This should be the floor for a lower trading market. The USDCAD is in a long-term holding pattern, and not too much is likely for the downside. If this currency dips below here the downside target level will be where the Bears will be making a run for.