The Tiger Forex Report 7-29-24

The Tiger Forex Report – Week of 7/29 – 8/2/2024

The DXY continues to show weakness, and more downside action is expected.

Crude Oil remains in a slump, but it looks like the market is ready to settle into a range trade.

30yr T-Bond likes the inflation data even though it is very slight. Momentum is on the side of the Bulls, and a run for the upside breakout level this week is likely.

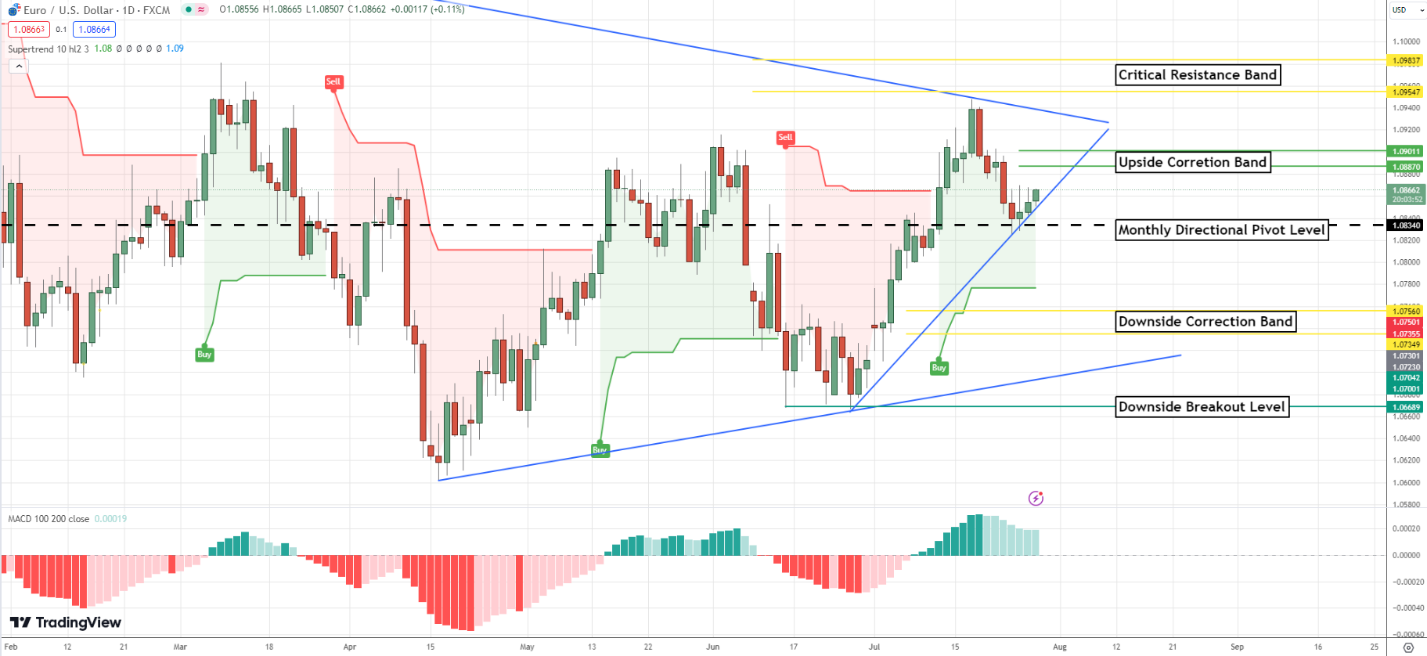

EURUSD Weekly Outlook:

The EURUSD bounced off the monthly directional pivot level and higher move highs on the intra-day level should occur this week. A rally into the upside correction band may be all that we will see until after the FED meeting. If the Bulls breach 1.0901 all bets are off. Trading above this level could accelerate the move. The critical resistance band is the upside extreme.

Only a break below last week's low would reverse the outlook to Bearishness. The monthly directional pivot level will be the first stop on a slide that could reach the downside correction band. It is not likely that the Bears will see these levels anytime soon. However, if Yields firm up sharply the EURUSD could start to probe newer move lows.

GBPUSD Weekly Outlook:

The GBPUSD Bulls are fighting to reverse the trend. More Bullish strength is expected early in the week. As of now, the upside correction band is a very reachable rally objective. This area should put the lid on higher move highs and a digestive range trade is expected. Only a close above 1.2948 would confirm the market's intentions to really blast through resistance and make a run for the upside breakout level. 1.3125 is the longer-term Bullish target.

If the Bears can get a dip under last week’s low the market should make it into the downside correction zone. Not much more is on the agenda for a lower move this week with Yields in retreat. It would take a reversal in the interest rate market to fuel any extended move lower this week. In the event that the GBPUSD closes below the 1.2780 it would be unwise to try and pick a bottom. That would put the monthly directional pivot level a viable longer-term target.

USDCHF Weekly Outlook:

The USDCHF is trying to find a floor to bounce off. This market remains in sell-rally mode. Another drop into the short-term sell-off zone is expected early in the week. This area should hold, and a range trade will most likely develop and digest the recent lower move lows before pressing on. That would make the monthly directional pivot level a viable target over the next few weeks.

If the market remains above last week's low the Bulls may be able to get a rally to the upside correction zone. The USDCHF is not expected to get above this area. Only a rally above the upside breakout level would confirm a shift in momentum to the Bulls. Trading above this area would be an indication that the longer-term trend is spinning back to Bullish control. New multi-month highs would be likely over the next few weeks as well.

USDJPY Weekly Outlook:

Volatility is kicking up its heels in the USDJPY. It may be time for a pause for the cause this week. The critical short-term correction band is likely to hold this market up. Watch Crude Oil this week. If there is a bounce in that market it stands to reason that the lower trading USDJPY will slow its Bearish decline. If this FX pair gets below 152.08 it would be a good sign that the Bears are intent on hitting the critical BOJ threshold level.

Trading above 153.54 will have this currency in the chop zone, and it could get very tough to trade for a few days. Not much is expected to the upside with Yields in a negative way. If Crude gets a rally and Yields pop, then the USDJPY Bulls might make a play for the upside correction zone. Not much more is likely this week. If there is a close above the 158.18 level there will be an update.

AUDUSD Weekly Outlook:

The AUDUSD took a big hit last week and may be in for more of the same this week. Key off the monthly directional pivot level. Trading under here keeps the Bears' noses pointed lower. The downside target level is the objective. Not much more is expected. If there is a close below here there will be an update.

Sustained trading above 0.6552 puts the breaks on the lower move lows for a little while. If the Bulls can catch a solid bid the AUDUSD could make it back up to the critical profit-taking area. Only a close above this area would confirm that the market is spinning the long-term trend back into Bull mode. However, this is not likely anytime soon unless there is a big turn in Yields.

NZDUSD Weekly Outlook:

Slamajama! The market is flirting with the downside target level. A break under here should help the market reach the downside target level. Most likely the market will be finding an area to settle into a range trade for a few sessions. 0.5575 is the longer-term sell-off objective.

If the Bulls get a bounce this week it will most likely be a grind higher. Use caution buying into this market. It is unlikely that there will be a big move higher any time soon. The upside correction zone is the lid for any rally this week. Once again. Be very careful playing the upside over the next few trading sessions.

USDCAD Weekly Outlook:

Can the USDCAD keep the rally going? The DXY may be weak, but that does not seem to have any influence here. 1.4010 and 1.4250 are the upside targets. Trading at these higher levels would be a big sign that the monthly trend is set to remain firm for a few weeks.

A short-term correction is very likely. If the Bears can get a grip on the market, then the profit-taking zone becomes a very reachable objective. Not much more is likely considering the strength of this current rally. Only a sustained trade below 1.3717 would confirm the USDCAD Bears' intention to drag the market all the way back toward the critical support band. 1.3507 is the long-term downside target.

TFNN is currently running our July Tiger Dollar sale, where we have doubled all the bonuses you receive. Tiger Dollars are good for all TFNN newsletters and services, and as current subscribers they are a great way to add savings to your subscription. You can now get a 20%, 30%, or 40% bonus depending on your purchase. Click here to get your Tiger Dollars before this sale ends.

IMPORTANT NEWS: Tom O'Brien is hosting a LIVE TRADING EVENT on Friday, August 2nd from 9am-12pm EST. Tom will be trading the SPX, QQQ, NDX, and 0DTEs. Additionally, all subscribers to the live trading event will receive a month free of Market Insights along with a signed copy of Tom's book The Art of Timing The Trade! Make sure to reserve your spot today!