The Tiger Forex Report 7-31-23

The Tiger Forex Report – Week of 7/31 – 8/04/2023

The DXY had some wild volatility last week, and the index is hovering around a critical long-term directional pivot level. Key off 101.70 for directional bias.

Crude Oil Bulls are stampeding their way higher. 84.98 is the first target on a move that could hit 87.50 before there is a pause.

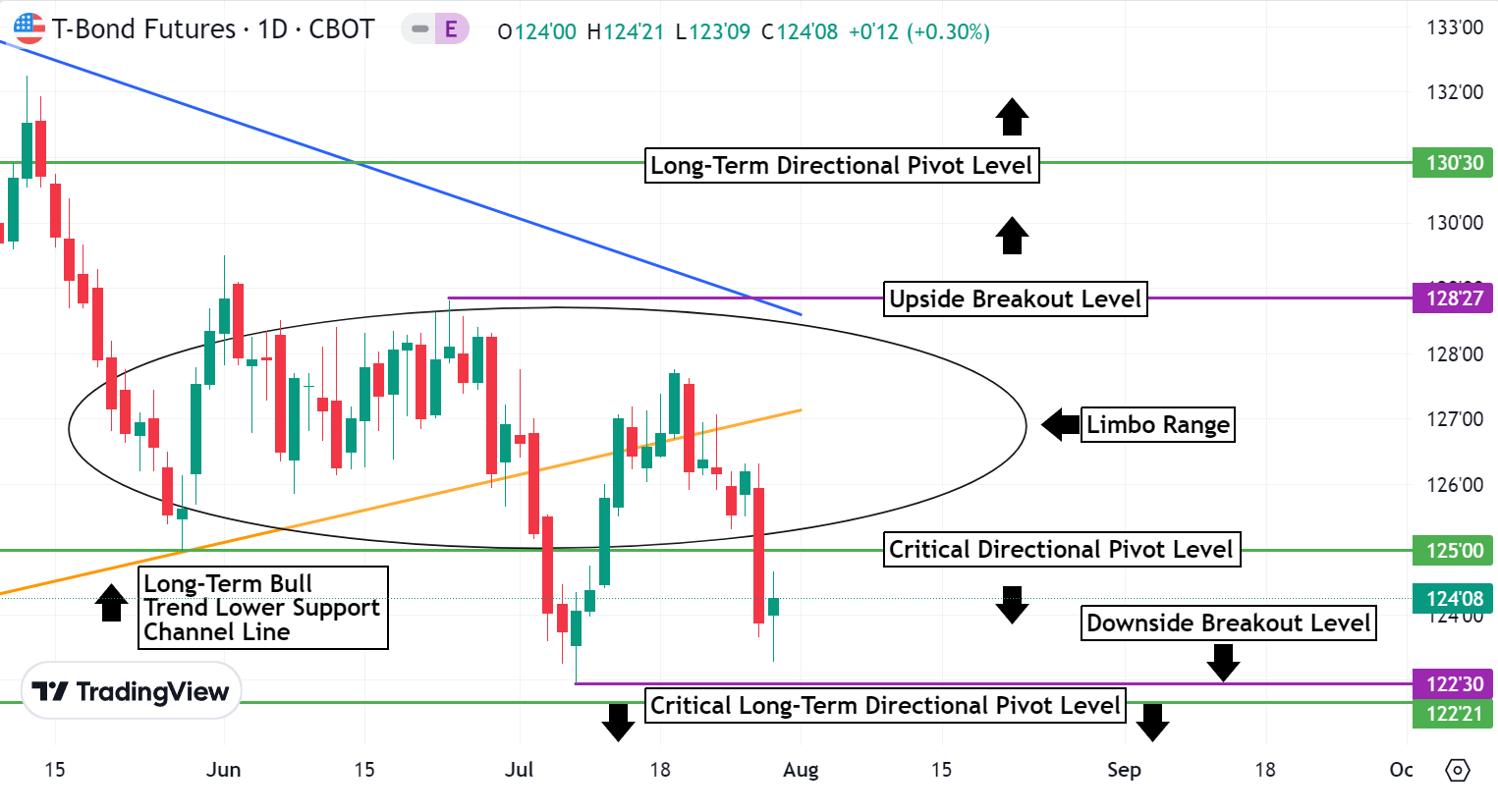

30yr T-Bond Bears pressed Yields higher last week. The question is will they continue the short-term trend? Employment numbers keep ticking lower…so that means the FED will remain Hawkish. Higher Yields are coming ahead.

EURUSD Weekly Outlook:

Central bank actions sent the EURUSD into a bit of a tizzy the last couple of sessions. The corrective trend is still in place. An early test of support is likely this week. If the market sinks below Friday’s low, then a fresh wave of selling targets the downside breakout level. This is a key area for the market. A failure here would confirm a longer-term shift in the trend. Trading under 1.0834 will have the Bears eyeballing the downside correction zone.

The longer-term trend is a Bull for the EURUSD, but the market remains in neutral below the upside breakout level. A print above here should spark fresh buying and a test of the upside target level. All trading above 1.1362 is a positive indication that the market is set to make a play for the 1.1380- 1.1406 resistance band.

GBPUSD Weekly Outlook:

Quite the whipsaw trade in the GBPUSD last week. Key off Friday’s low for directional bias. Trading above here keeps the market on pause to digest the recent market action. It will be a choppy range trade between the breakout levels. The short-term trend is a Bear, and a failure from the downside breakout level confirms extended weakness that targets the downside correction zone. This should be it for a lower trading market this week.

If the Bulls can breach the upside breakout level, then expect a challenge of the upside target level. Remember the long-term trend is a Bull still. Trading back in this upper area by the GBPUSD is a positive indication that fresh buying may enter the market. Momentum is likely to build then, extending the upside objective to the 1.3265 – 1.3277 resistance band. The BOE also may still have some Hawkish tactics that may also come into play that would reinforce the Bull trend too.

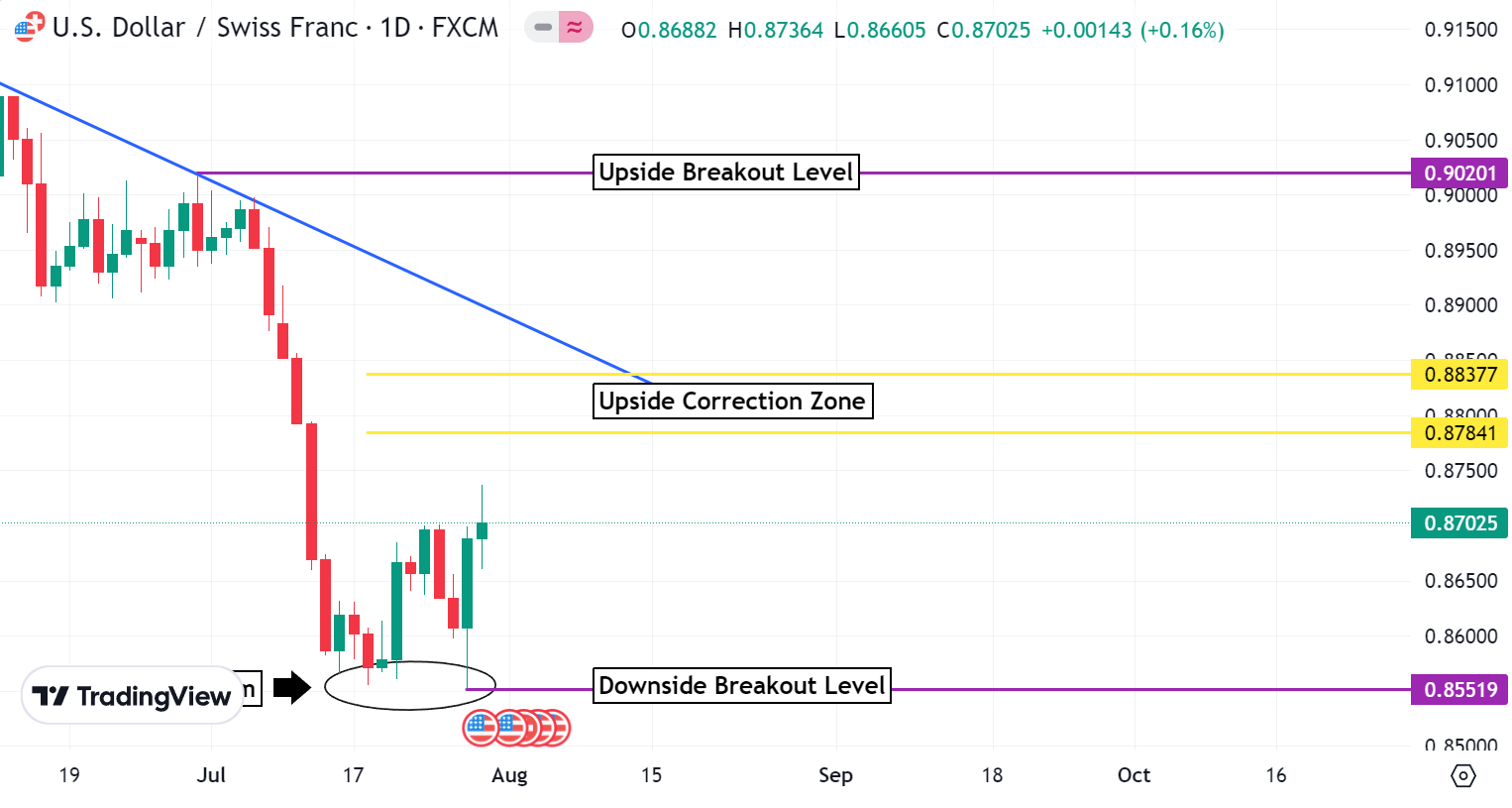

USDCHF Weekly Outlook:

We have a double bottom in place, and this sets the tone for the week ahead. Trading above the downside breakout level will keep the USDCHF in a neutral to higher posture fighting to make a run for the upside correction zone. This is all that is expected out of a corrective rally. Only a close above 0.8837 would confirm a short-term shift in momentum that would target the upside breakout level.

Do not fight a dip below the downside breakout level. Could a triple bottom occur? Of course, but not likely. A failure from the downside breakout level is a negative indication that the market has every intention of slamming this currency down to the 0.8474 level. If this occurs it would not be a good idea to fade the Bears. A new leg lower has the potential to reach the 0.8295 area before there is another significant retracement higher.

USDJPY Weekly Outlook:

Just a swinging. Talk about a fun market to trade lately. The USDJPY reacted to FED and BOJ actions last week, and the currency is set for another challenge of resistance. A move towards the upside breakout level is the early week special. Do not fight a rally above the 142.25 level. Upside momentum is likely to get stronger here. Trading above here would be a very Bullish sign that this currency has every intention of pressing multi-month highs towards the 146.50 area.

If the market falls below the downside breakout level it would be a very negative sign for the USDJPY. Trading under here would confirm a major shift in trend that targets the 132.75 level. Yes, that is correct. This is highly unlikely though because of the overall Bullishness of the long-term trend.

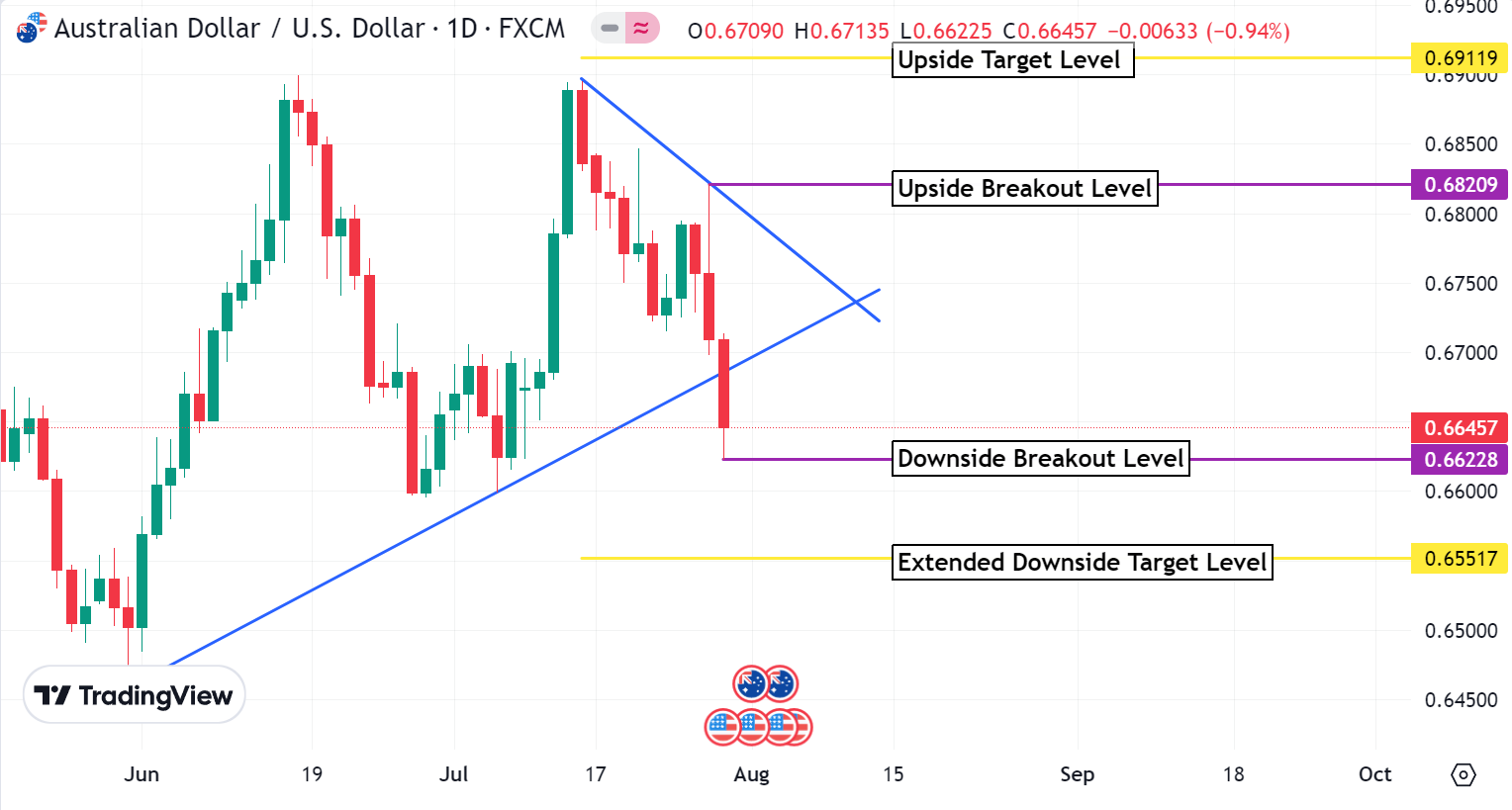

AUDUSD Weekly Outlook:

The Bears are pressing support hard. Use the downside breakout level for directional bias. A failure from this level is a negative sign that the AUDUSD is going to make a play for the extended downside target level. It has been a wide range trade for this currency pair for quite some time. If the Bears get below 0.6551 then it would be a very Bearish indication that the market is looking to press an extended leg lower down towards the 0.6344 level.

Between the breakout levels it is likely to be a choppy range trade. Only a rally above the upside breakout level confirms fresh strength for a challenge of the upside target level. This is the upper end of the multi-month range trade, and it should cap any Bullish intentions. The AUDUSD is fundamentally a disaster right now.

NZDUSD Weekly Outlook:

The NZDUSD is in a very negative sell posture, and a test of support is in the cards for early in the week. A dip below the downside breakout level will keep the Bears on a mission for the downside target zone. If there is any support in the market it will be found in this area. All trading below 0.5999 is a Bearish confirmation that this trend is gaining momentum. 0.5780 is the extended Bear trend target.

Trading between the breakout levels will be tough. Only a rally above the upside breakout level would confirm strength for a pop up to the upside target level. This should stop the Bulls in their tracks. The fundamental outlook for this FX pair is bleak at best. If the market gets above the upside target level, we will have an update.

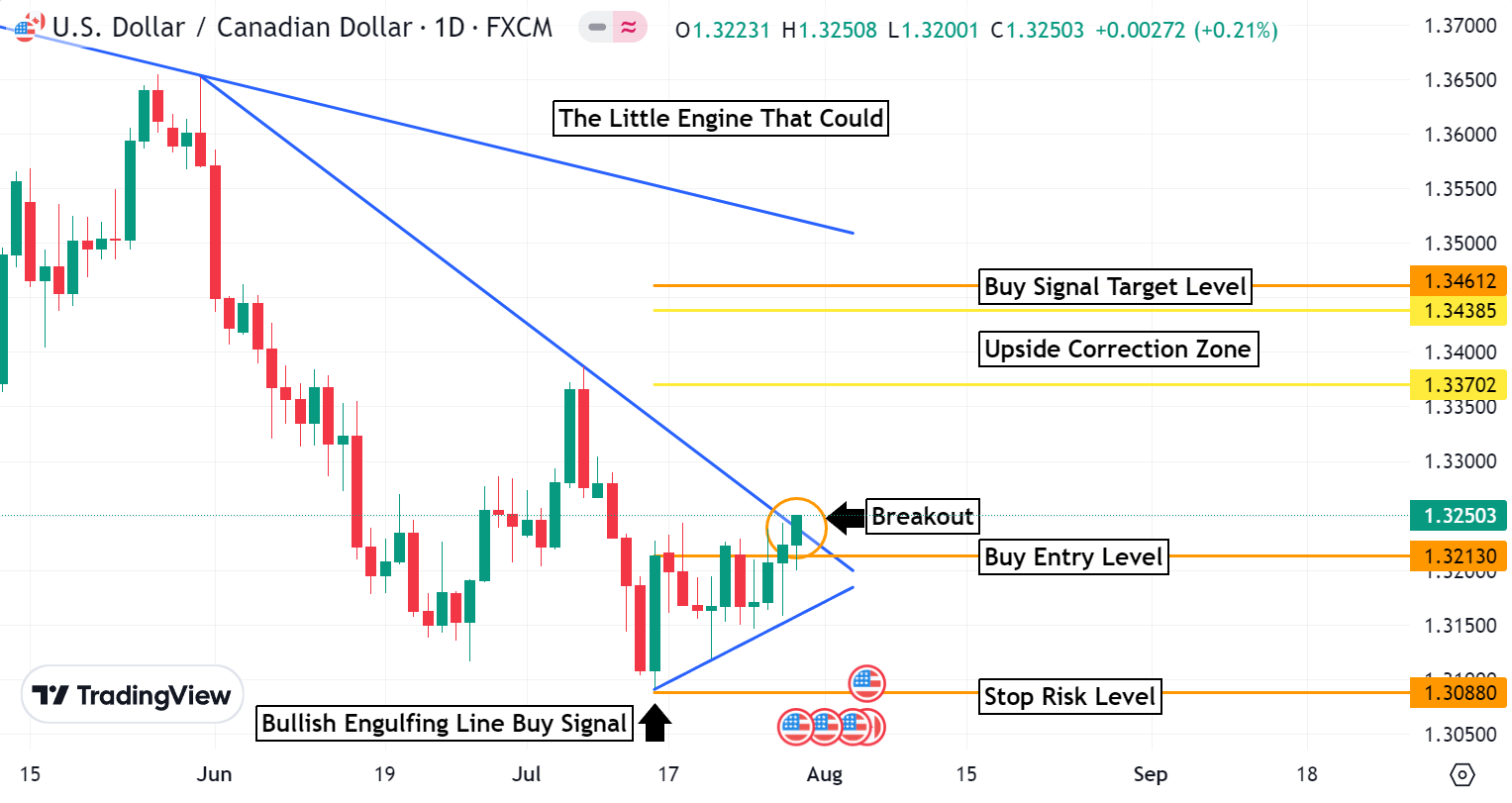

USDCAD Weekly Outlook:

An upside breakout is in play and reigniting our Buy signal. The Bulls lifted the USDCAD to new move highs, and the likelihood of more upside action to come is good. Expect more higher trading, and a test of the upside correction zone. If the market gets into this area, then it is a good indication that our Buy signal target level should get hit.

Only a failure from the 1.3088 level confirms that the Bears are back in full control. 1.2966 is the first objective for a new leg lower that has the potential to reach 1.2850. If this scenario pans out, then it is likely that the DXY is getting slammed. Then it would be a very good idea to wait for a strong Buy signal again before fading the Bears in the USDCAD.