The Tiger Forex Report 7-6-22

The Tiger Forex Report – Week of 7/04 – 7/08/2022

Forex pairs are having trouble holding the USD at bay. An early show of strength is very likely this week. Short-term momentum is positive, and the major currency pairs are not showing signs of firming up.

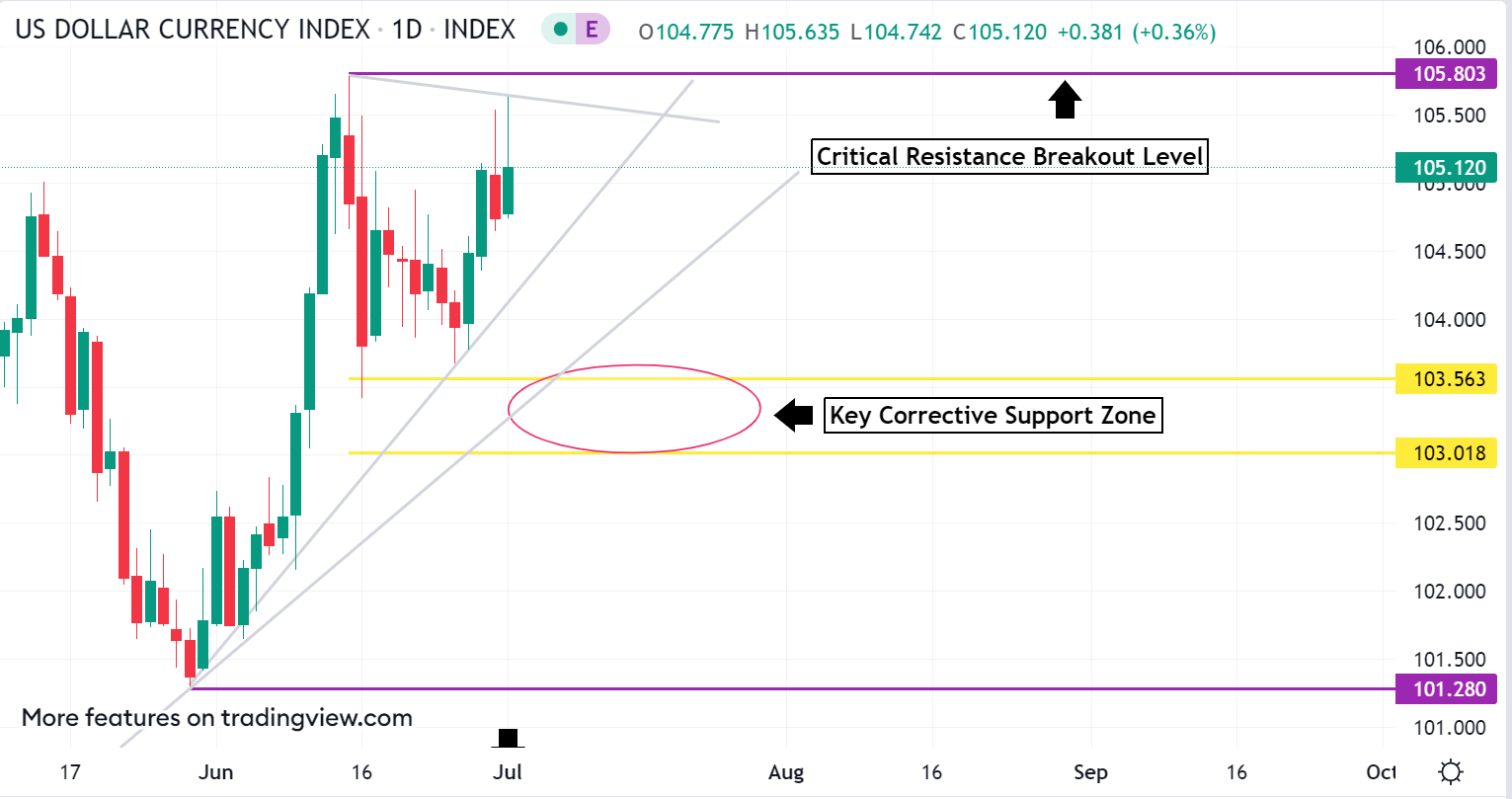

Key levels to watch for in the DXY…

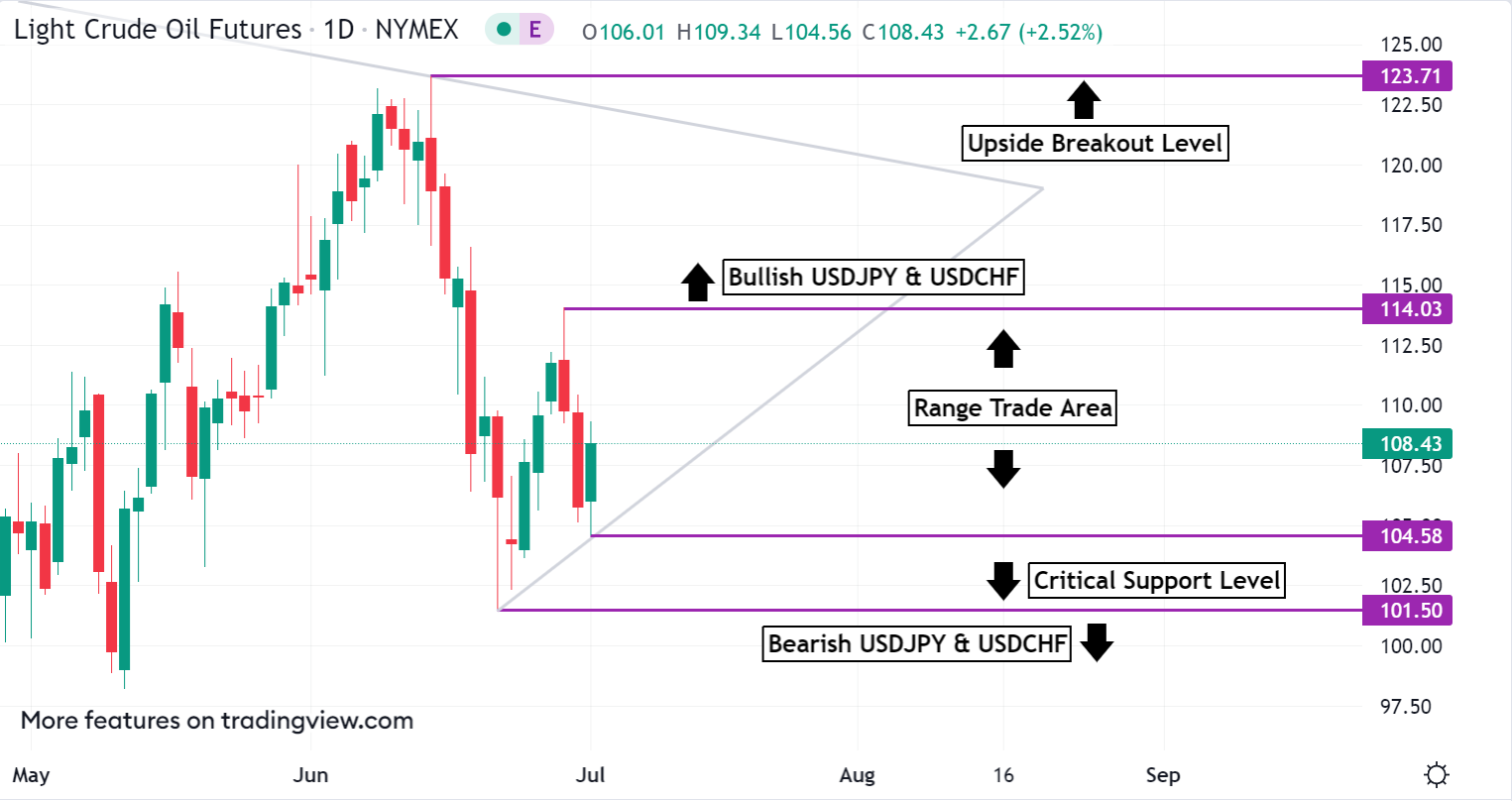

Crude Oil is grappling with direction…

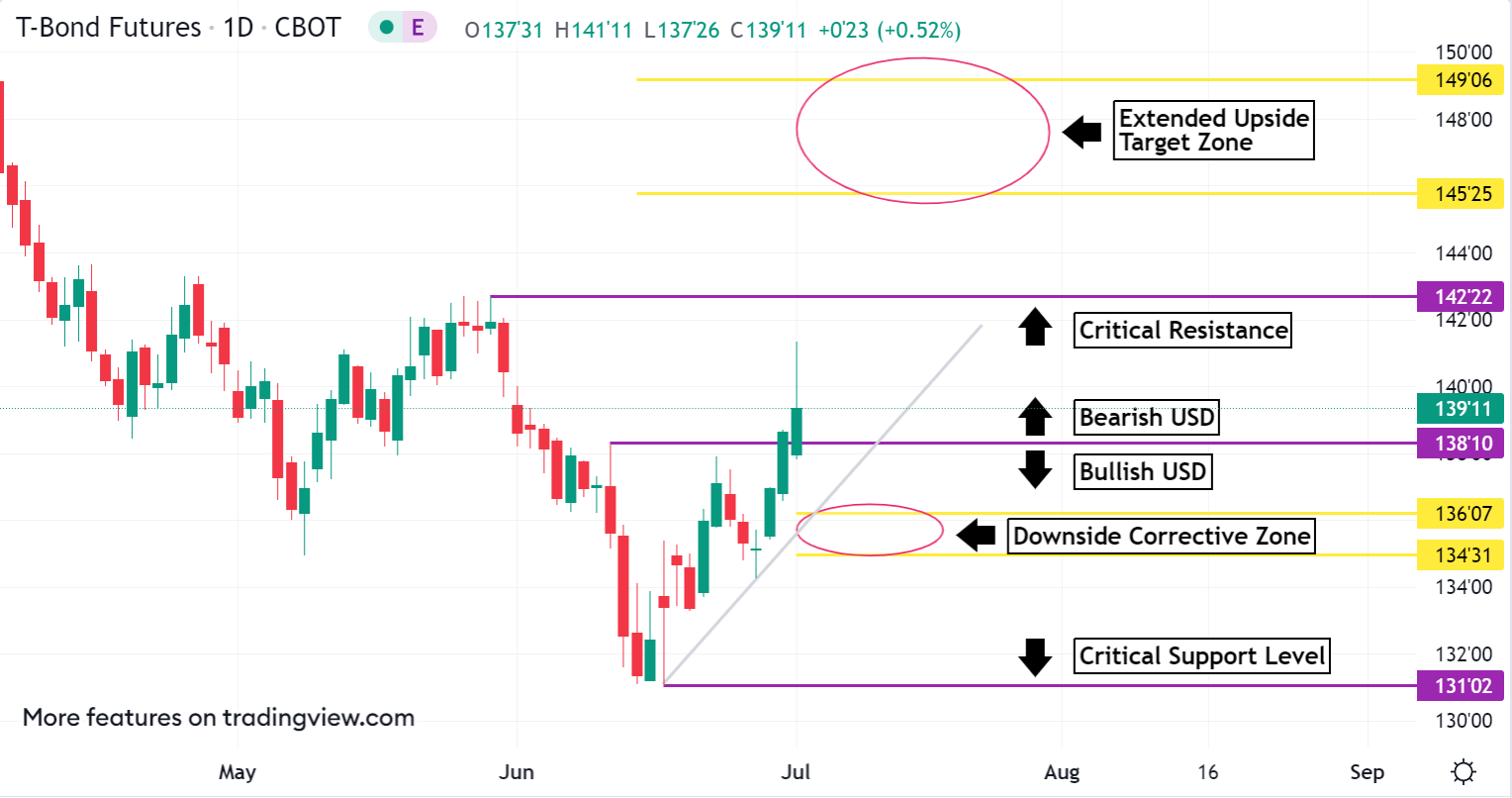

30yr T-Bond levels to watch out for…

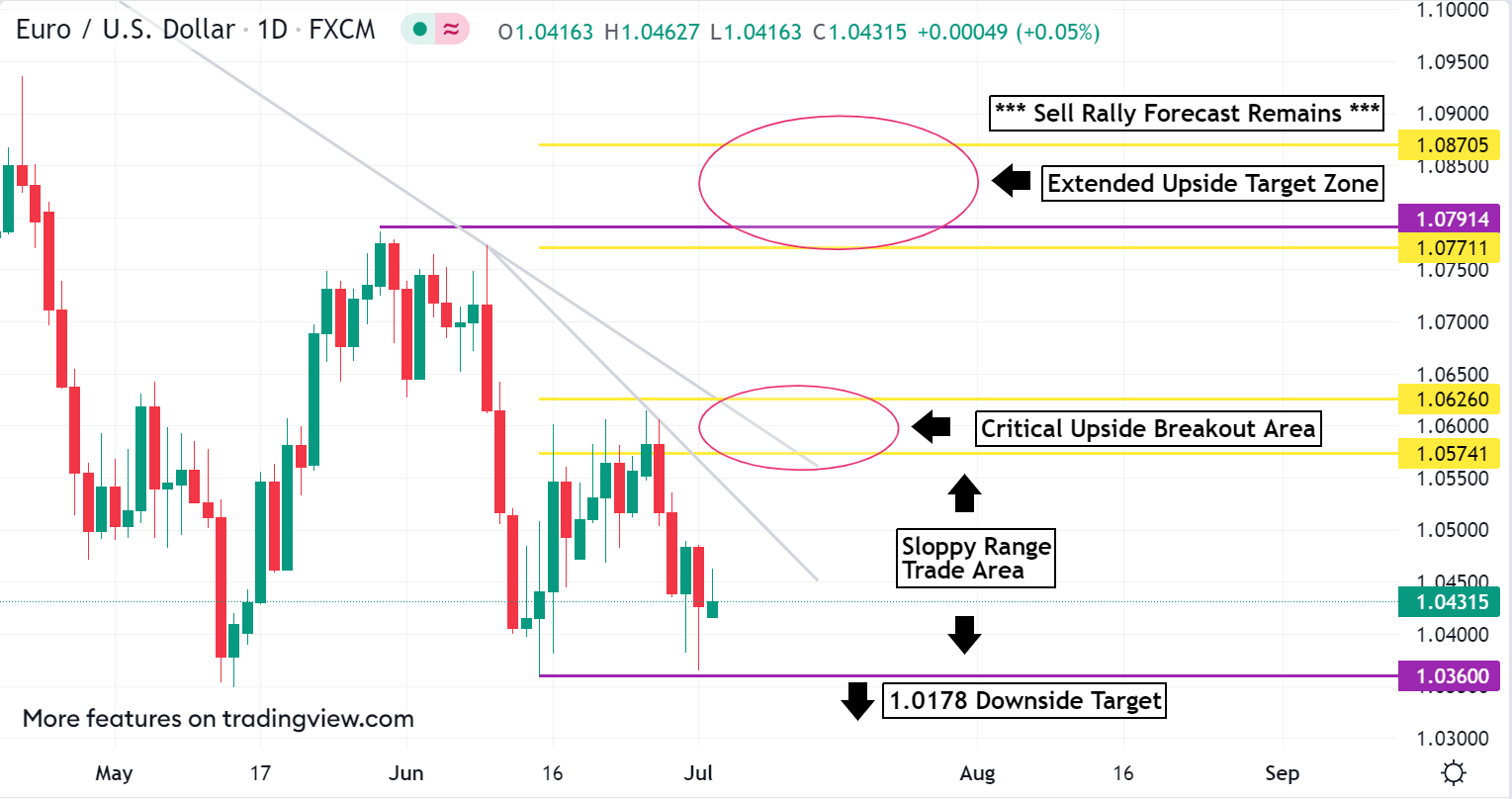

EURUSD Weekly Outlook :

EURUSD Bears continue to keep this market in the gutter. An early test of support is likely as downside momentum grinds lower. Use caution if there is a dip below 1.0360. Fresh selling is likely here with 1.0178 as the downside objective.

Trading above 1.0360 keeps this pair in a tug-o-war range trade up to the 1.0574 - 1.0626 critical upside breakout area. The Bulls have failed to breach this resistance over the past few weeks. If there is to be any extended leg higher a Close above 1.0626 is necessary. 1.0771 – 1.0870 is the longer-term bullish objective area. However, this is unlikely unless there is a huge sell off in Crude Oil and a monster rally in the U.S. interest rate complex.

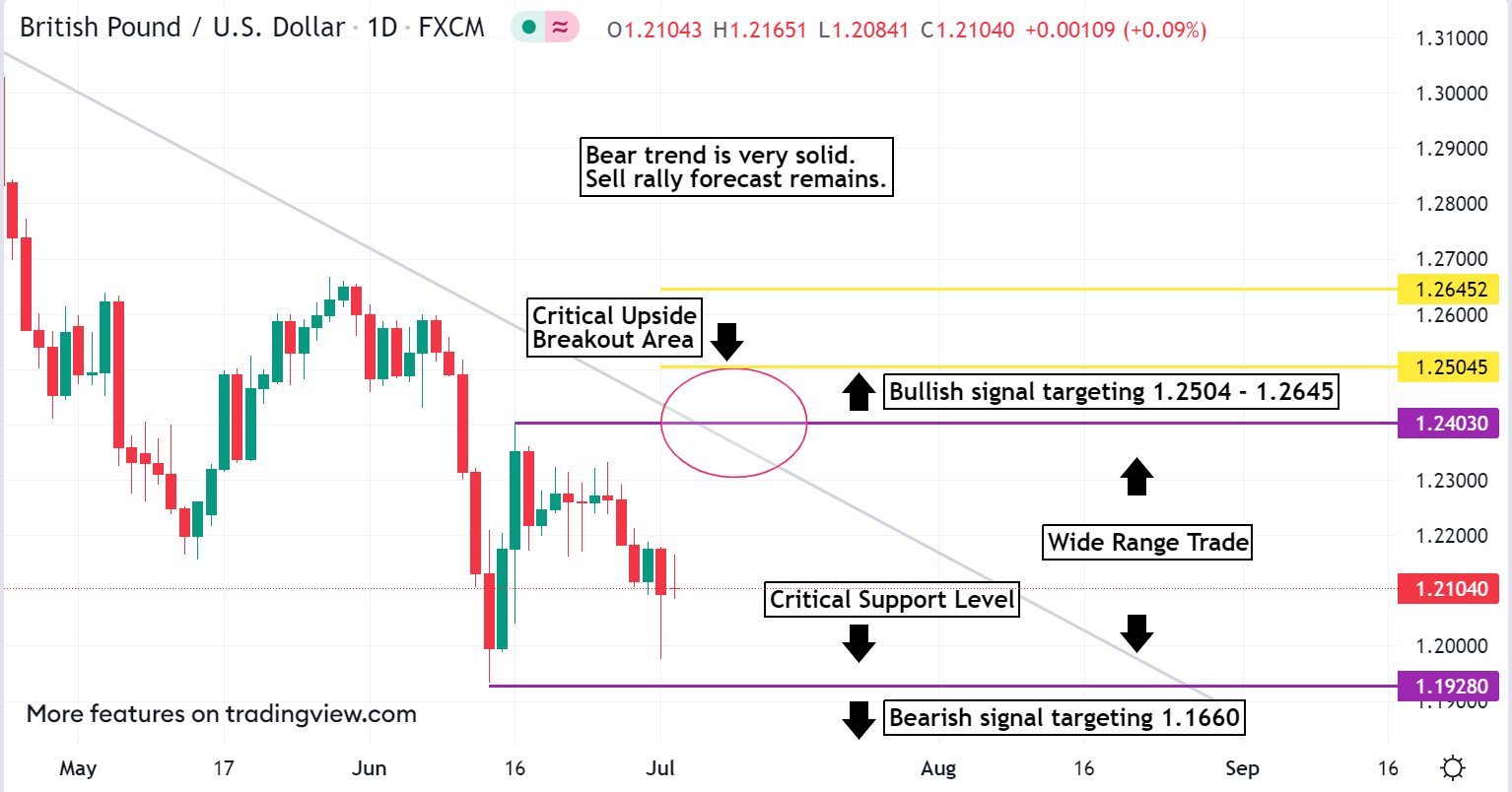

GBPUSD Weekly Outlook :

The Bears remain in control of the GBPUSD. Lower move highs, and lower move lows, keep the trend intact. An early test of support is on the menu for this week. Do not try and catch a falling knife. A failure from the 1.1928 level will keep this cross rate looking for new move lows. 1.1660 is the downside objective.

Trading above 1.1928 will hold this Forex pair in a wide range trade up to 1.2403. It is unlikely in the present market environment that any upside correction will hold up. Fundamental and technical variables keep this FX pair in a Bearish posture. Only a Close above 1.2403 confirms strength. 1.2504 and 1.2645 are the extended upside targets.

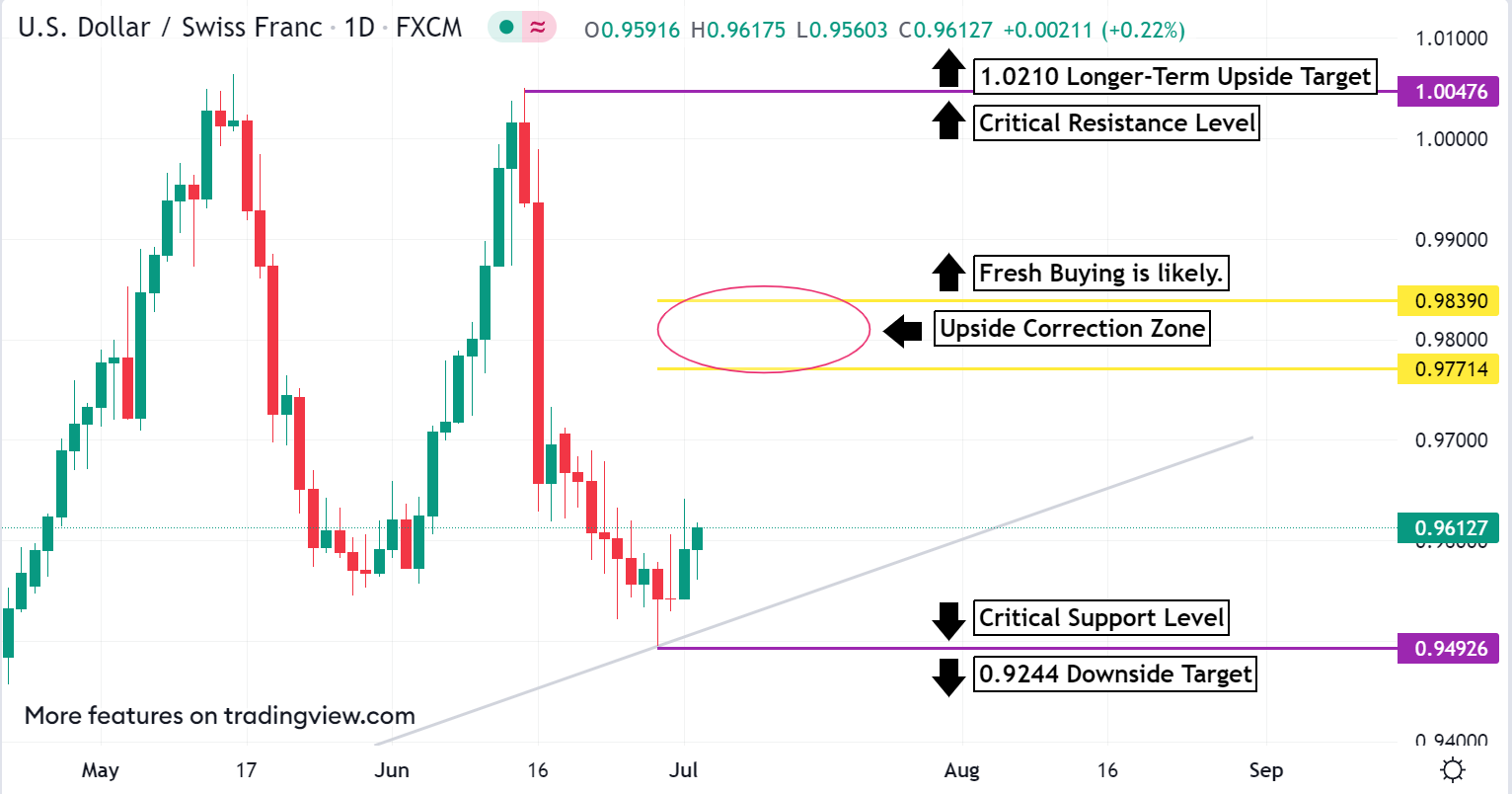

USDCHF Weekly Outlook :

Trading the Swissie has been a rough go of it the past couple of weeks. Key off of last weeks low. Trading above 0.9492 favors the Bulls as they target a bounce back up to the 0.9771 – 0.9839 correction zone. Be aware of the U.S. interest rates. If the 30yr T-Bonds start to sell off then a big rally is very likely in the USDCHF. Throw in a big rally in the Crude Oil market, and the critical resistance level at 1.0047 becomes a feasible objective. 1.0210 is the longer-term upside target.

A slide under 0.9492 puts this pair back on edge. 0.9244 is the downside target. Under current market conditions this is not likely without a large rally in the U.S. 30yr T-Bonds.

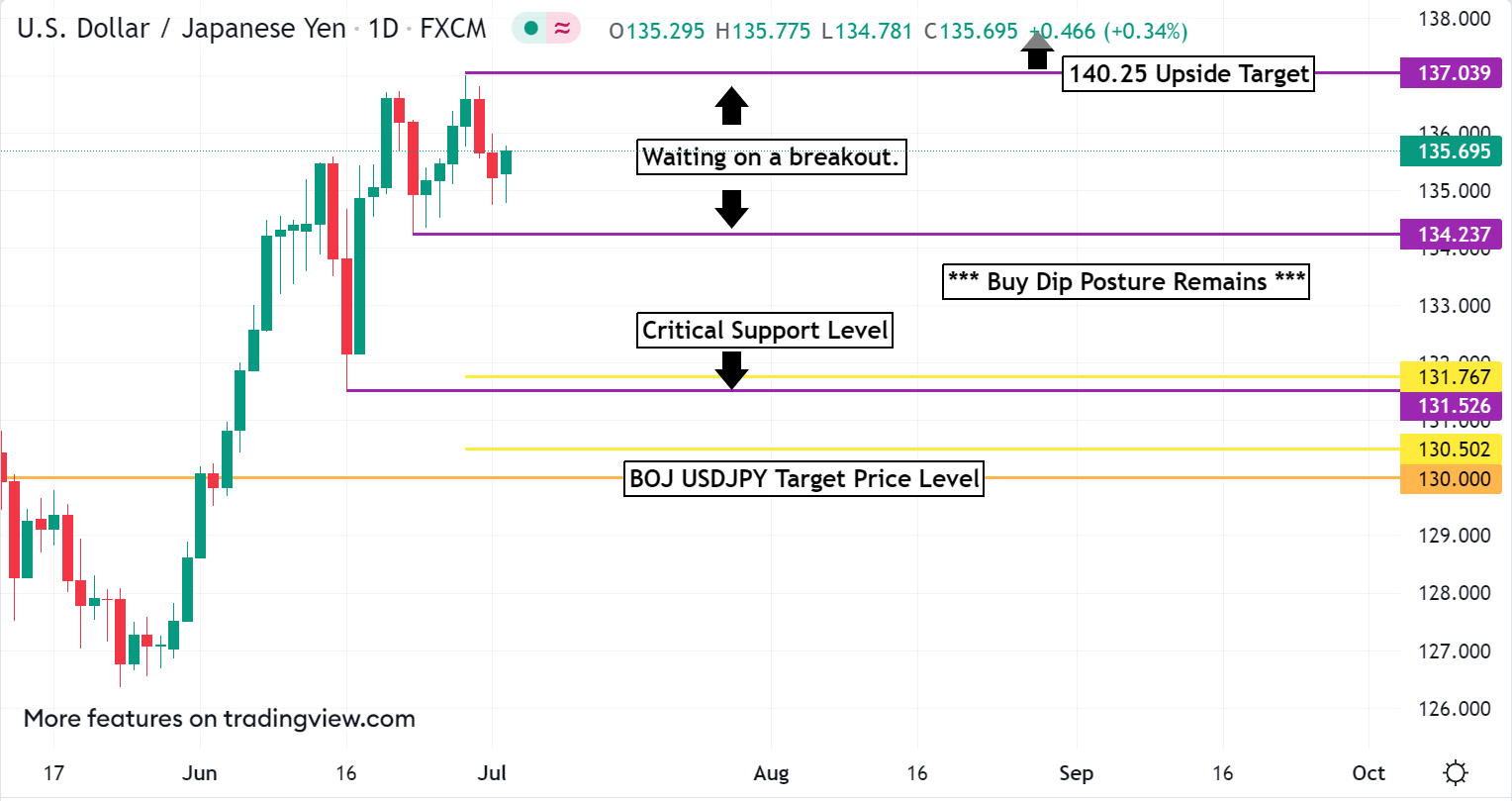

USDJPY Weekly Outlook :

USDJPY has been consolidating just below recent highs. The market remains a Bull, and a challenge of 137.03 is in the cards this week. Do not fight a rally above here. Upside momentum is likely to build driving this currency up to the 140.25 upside target.

Trading under 137.03 keeps this Forex market in limbo down to 134.23. A failure here is necessary to confirm new move lows, and a short-term trend change. The 131.76 - 131.52 support band is about all that is expected from any harsh sell off. A big break in Crude Oil and a big rally in the 30yr T-Bond would be needed to accomplish any longer-term negative trend. Until then it is in a buy dip forecast.

AUDUSD Weekly Outlook :

Downward pressure is not giving up on the AUDUSD. An aggressive sell posture aims this pair at the 0.6762 support level. Weakness is expected to grow below here. 0.6588 is the Bearish downside target.

Trading above 0.6762 holds this FX pair afloat trying to make a run at the 0.6914 – 0.6951 upside target zone. This is where the market is likely to run out of gas. Only a sustained trade above 0.6951 confirms strength for a longer-term upside correction that targets the 0.7023 – 0.7086 critical resistance zone.

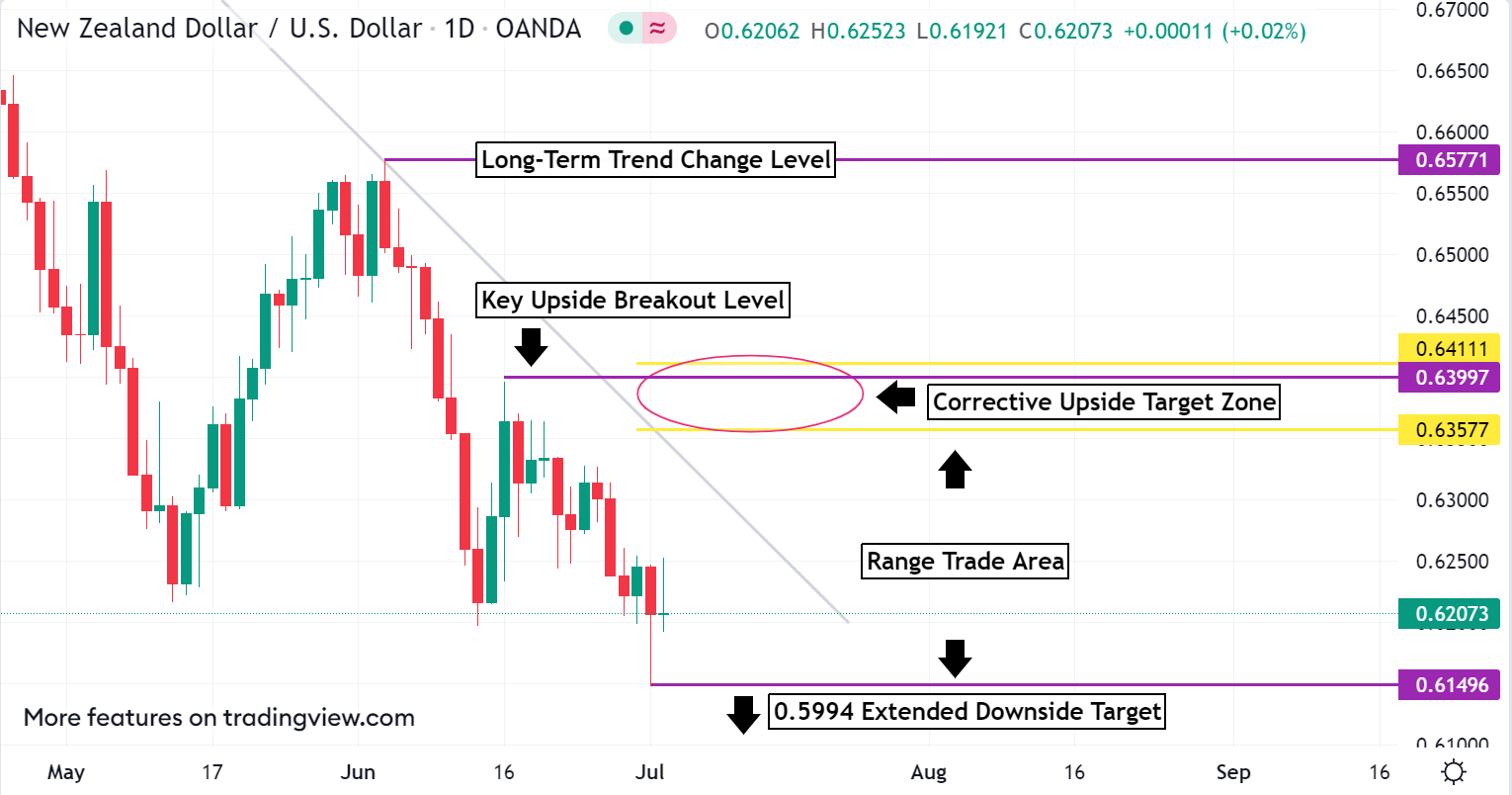

NZDUSD Weekly Outlook :

NZDUSD traders are unlikely to find any sustainable rallies for a while. Lower move lows are likely early in the week watch out for the 0.6149 support level. All trading under here is a bearish indication that the market is not done hitting support. 0.5994 is the extended downside objective.

Trading above 0.6149 keeps this pair in a tough trade up to the 0.6357 – 0.6411 corrective upside target zone. With all of the bearish fundamentals and technical weakness it is unlikely that this market has the potential to press any aggressive move higher.

USDCAD Weekly Outlook :

If there is a market that aims to disappoint it is the USDCAD. Calling this market indecisive is an understatement. Expect more of the same. Above 1.2821 this FX pair aims towards 1.3017 up to 1.3079. Unless there is some big news event it is not likely that a rally can hold these upper levels.

Below 1.2821 the Bears are likely to drag the market lower into the 1.2797 – 1.2732 critical support zone. 1.2518 is the long-term downside objective. The trend is neutral with no short-term end in sight.