The Tiger Forex Report 7-6-23

The Tiger Forex Report – Week of 7/3 –7/07/2023

DXY Bulls like the FED’s clarity about remaining Hawkish. If Yields go up the USD should follow.

Crude Oil continues to remain in a holding pattern. More of the same is expected for the week ahead.

30yr T-Bond traders had a nice confirmation from the FED that the Hawkishness is not gone, and more is to come. Yields are on track to rise, and help boost the USD by default.

EURUSD Weekly Outlook:

EURUSD traders are in a quandary. The economy is collapsing in the EU, and Germany the engine is seizing up. Fundamentals are very Bearish, and the ECB is now a liability. Expect a sideways trade early this week in leu of the U.S. holiday markets. The downside correction zone is the objective for the recent Bearish slide. This is expected to hold up for a little while before the Bears really hit this market very hard.

Only a rally above the Upside Breakout Level confirms strength to catapult the Bulls to much higher levels. 1.1275 is the first stop on a move that targets the 1.1320 level. Use caution under the current market conditions. Yields are likely to go higher and help fuel the USD against many currencies. Rallies in the EURUSD are expected to falter. Giving traders ripe opportunity to sell at higher levels.

GBPUSD Weekly Outlook:

It is a big question for the GBPUSD. Is the market correcting, or setting a new direction? Fundamentals are weak, and a big sell off is on the menu. The market is fliting with the downside correction zone. It would be unwise to fight a dip under here. Fundamentals and a FED outlook that is Hawkish have this currency cross looking Bearish. Do not fight a failure from the 1.2511 level. Trading under here would be an indication that the market is set to press new move lows into the next couple of weeks.

Rallies are not expected to hold up this week. It will be a grind up towards the upside breakout level. Only a breach of this level would confirm Bullish resolve and extend the upside target to the 1.2945 area. If the GBPUSD regains this ground it is likely that the BOE may be flirting with a rate hike. In this case it would be unwise to fight the Bullish trend. Pay close attention to the economic numbers in the UK as a gauge for potential Bullish bias in this currency pair.

USDCHF Weekly Outlook:

More of the same is expected for the USDCHF. The upside potential is not as strong as it is to the downside. An early test of support is expected this week, and a slide under the downside breakout level is all that is needed to spark a wave of fresh selling pressure. 0.8780 is the first stop on a slide that has the potential to drive new monthly lows all the way down towards the 0.8650 area.

Trading to the upside will be a grind this week if the Bulls can get a hold of this market. Only a rally above the upside breakout level confirms strength for a challenge of the upside target level. This is the key resistance area to breach. If the USDCHF can pierce this area it would be a good sign that the Bulls are in charge, and the upside target would then be extended towards 0.9375.

USDJPY Weekly Outlook:

Wow what a Bull. Divergence from the main currency pairs is obvious here. A short-term turn to support is expected early this week to digest the recent run up by the Bulls. It would not be out of the question to slip back into the downside correction zone. If it is only a profit taking move then this area should hold firm. Only a failure from the 141.144 level would confirm a change in trend that extends the downside objective to the 139.332 level.

Be careful fighting rallies this week. If the USDJPY gets above the upside breakout level it would be a good indication that the Bulls are ready to drive this currency up towards the 148.400 level. The trend is very Bullish and will remain so until the BOJ makes a move. 150.00 is the long-term upside trend objective.

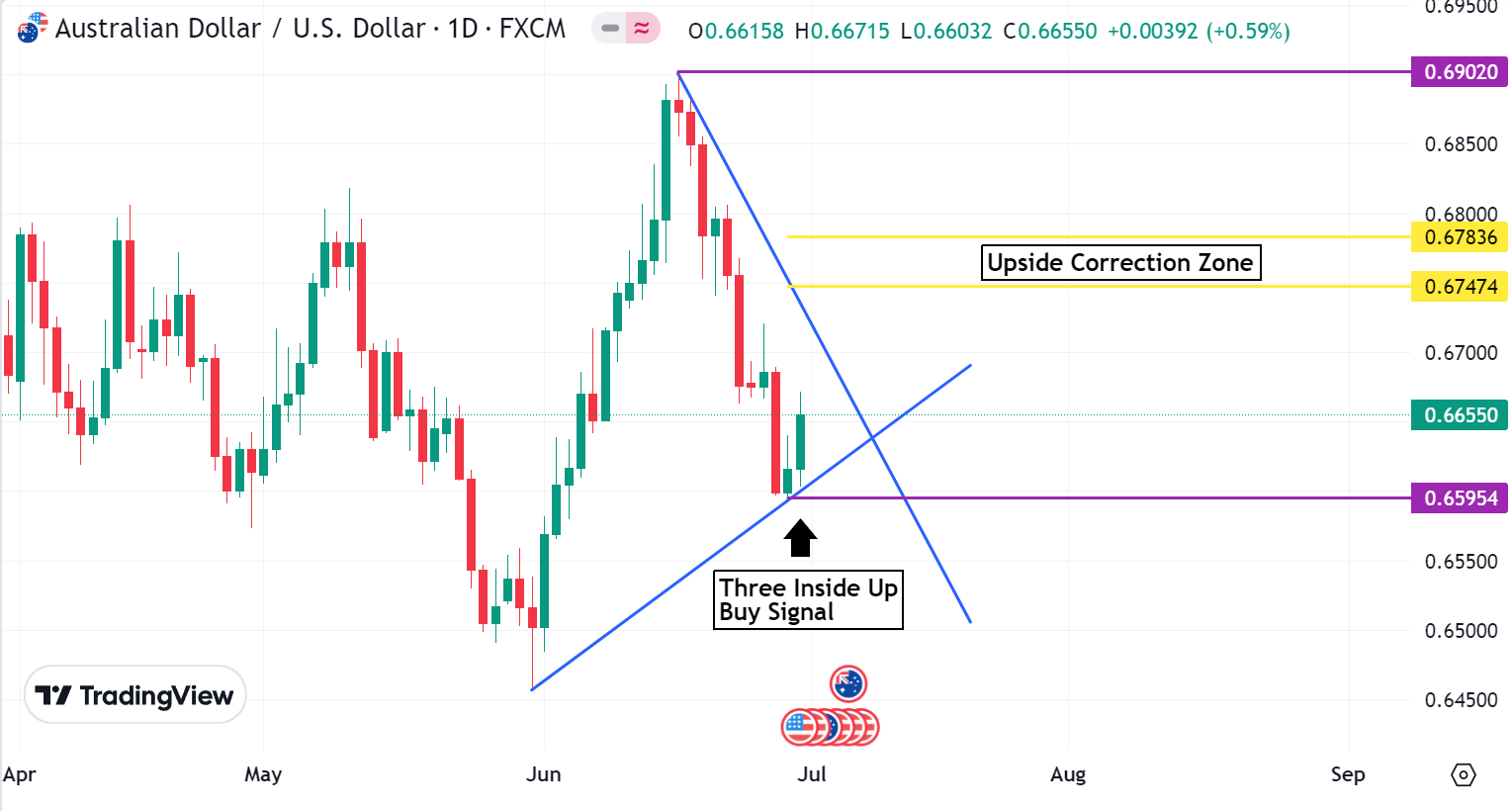

AUDUSD Weekly Outlook:

A short-term buy signal was triggered on Friday, and a follow through move to the upside is on the menu for the beginning of the week. The upside correction zone is the area to shoot for if the buy signal is solid. Over all the AUDUSD is a Bear. Only a rally above 0.6783 reverses the outlook and extends the upside target to the 0.6902 area. Although with the current fundamentals in place it is unlikely that the currency has the potential to regain Bullish momentum for very long.

Do not fight a failure from last weeks swing low. Trading below here would negate the buy signal and confirm that the Bearish trend is in full gear again. 0.6385 is the first stop on a break that has the potential to reach 0.6290 over the next couple of weeks.

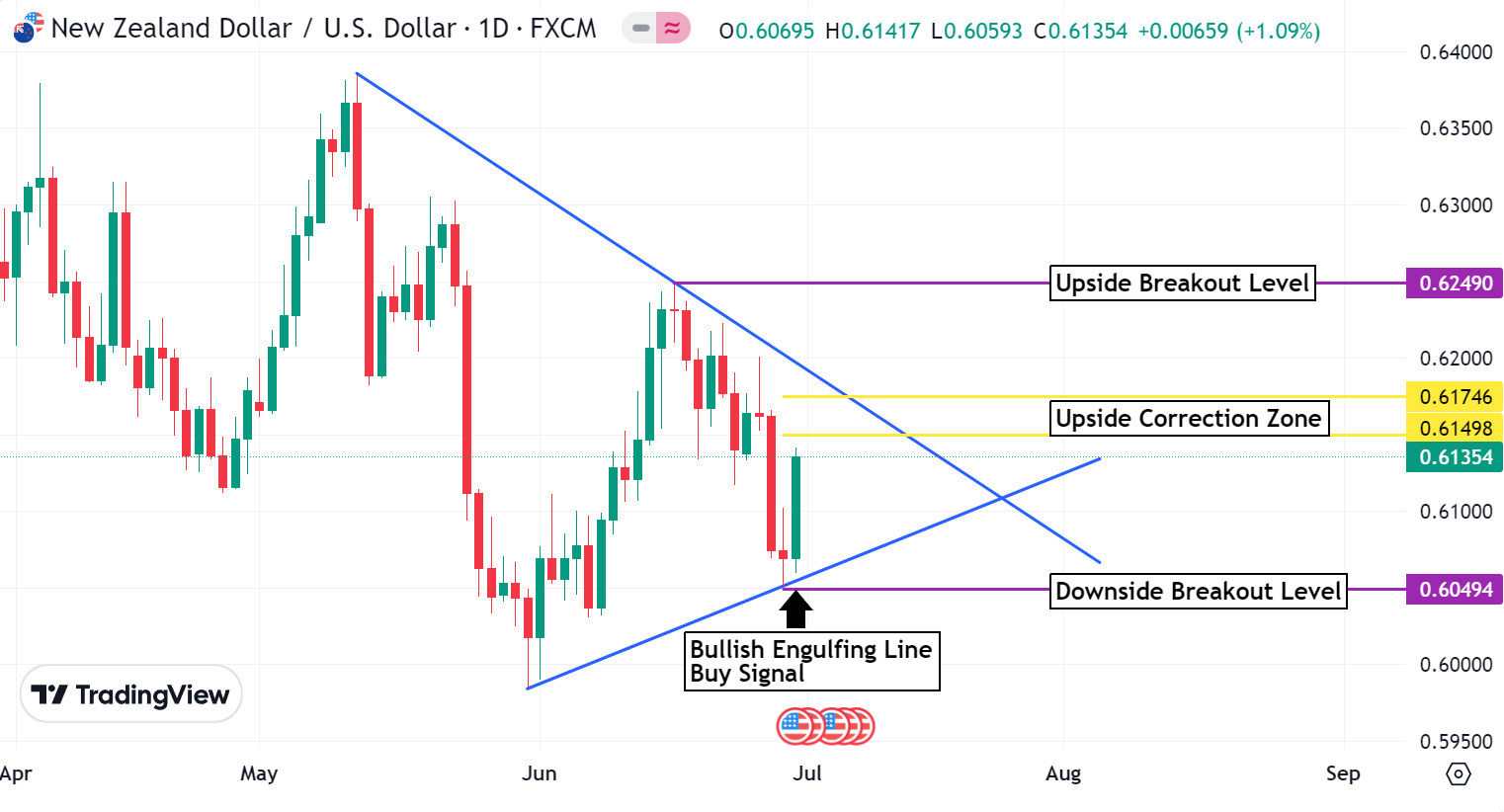

NZDUSD Weekly Outlook:

The Bulls ended last week with a buy signal. An early challenge of the upside correction zone is expected. This is it though. The Bearish trend is very strong, and rallies are not likely to hold. Only a move above 0.6174 confirms fresh strength. Trading back above here should have the NZDUSD flirting with the upside breakout level. If the USD starts to get hit hard this week, then the Bulls may be able to press the short-term trend to the upside.

Be careful buying into a failure from last weeks swing low. Trading back in this area would negate the buy signal, and confirm the Bears intentions to slam new monthly lows down towards the 0.5845 level. It would be a good idea to look to take profit on new move lows, but be careful trying to reverse your trade. If this currency touches off new monthly lows it could spark a huge wave of fresh selling pressure.

USDCAD Weekly Outlook:

The Bulls got a bounce last week, but do not get too excited. Only a rally above the 1.3303 level confirms strength for an extended rally up into the upside correction zone. This is all that is expected out of a follow through leg higher. Over all the trend in the USDCAD is neutral to Bearish. It would be unwise to forget this. Fundamentals are just not very supportive for this market right now.

If the Bears flirt with support it could get very volatile around the downside breakout level. Trading under here should set off fresh selling momentum that targets the 1.3075 level. If the USD is under pressure overall this week, then the USDCAD Bears may be able to slam new monthly lows very hard. 1.2990 is the extended sell off objective on a trend move that has the potential to hit the 1.2745 level before the month is out.