The Tiger Forex Report 8-22-22

The Tiger Forex Report – Week of 8/22 – 8/26/2022

DXY Bulls are back with a vengeance. Follow through is expected.

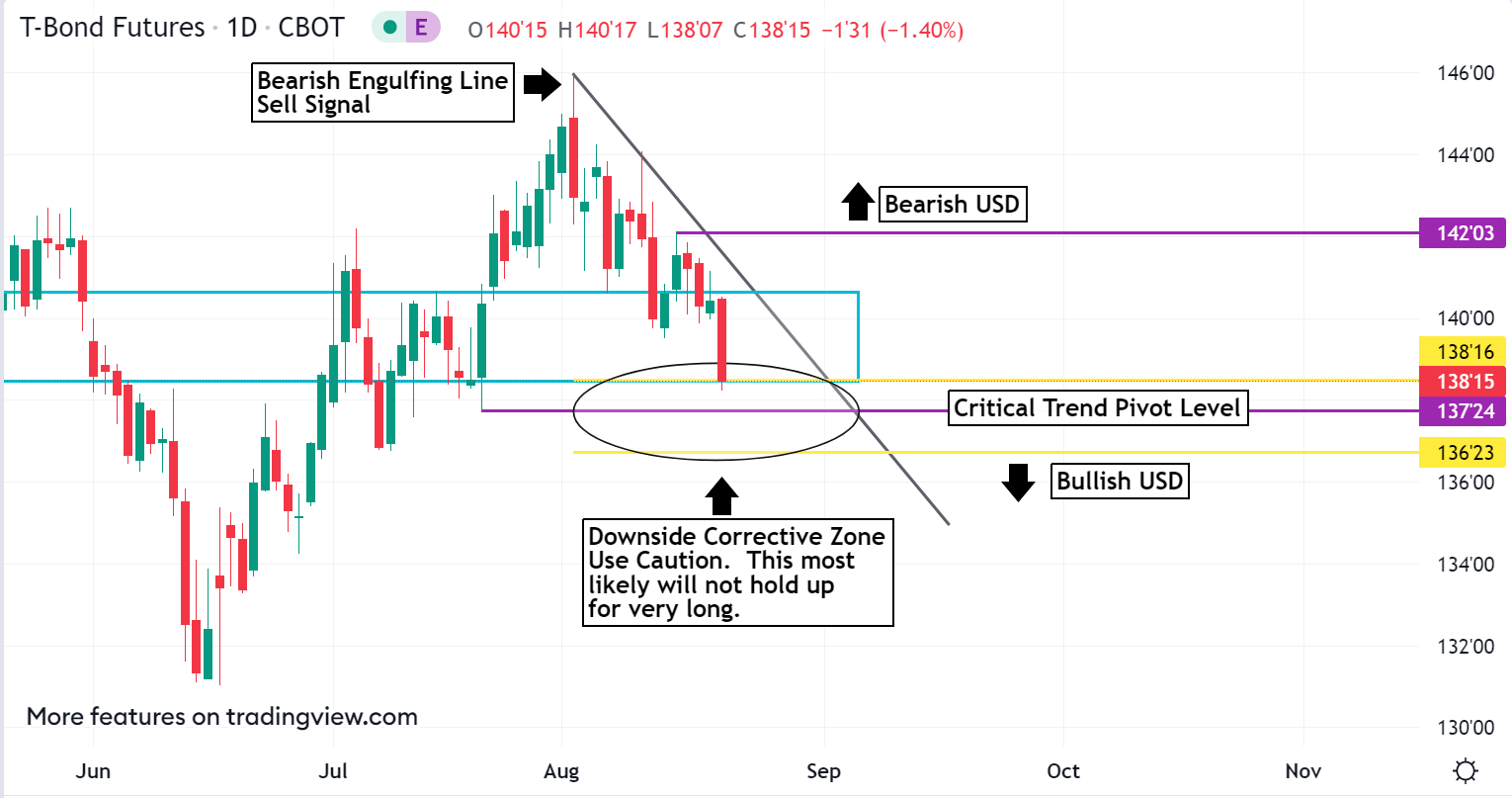

DXY is getting a boost from the slide in the 30yr T-Bond. The trend is your friend, and it would be unwise to jump in front of this train. More dollar strength is expected this week.

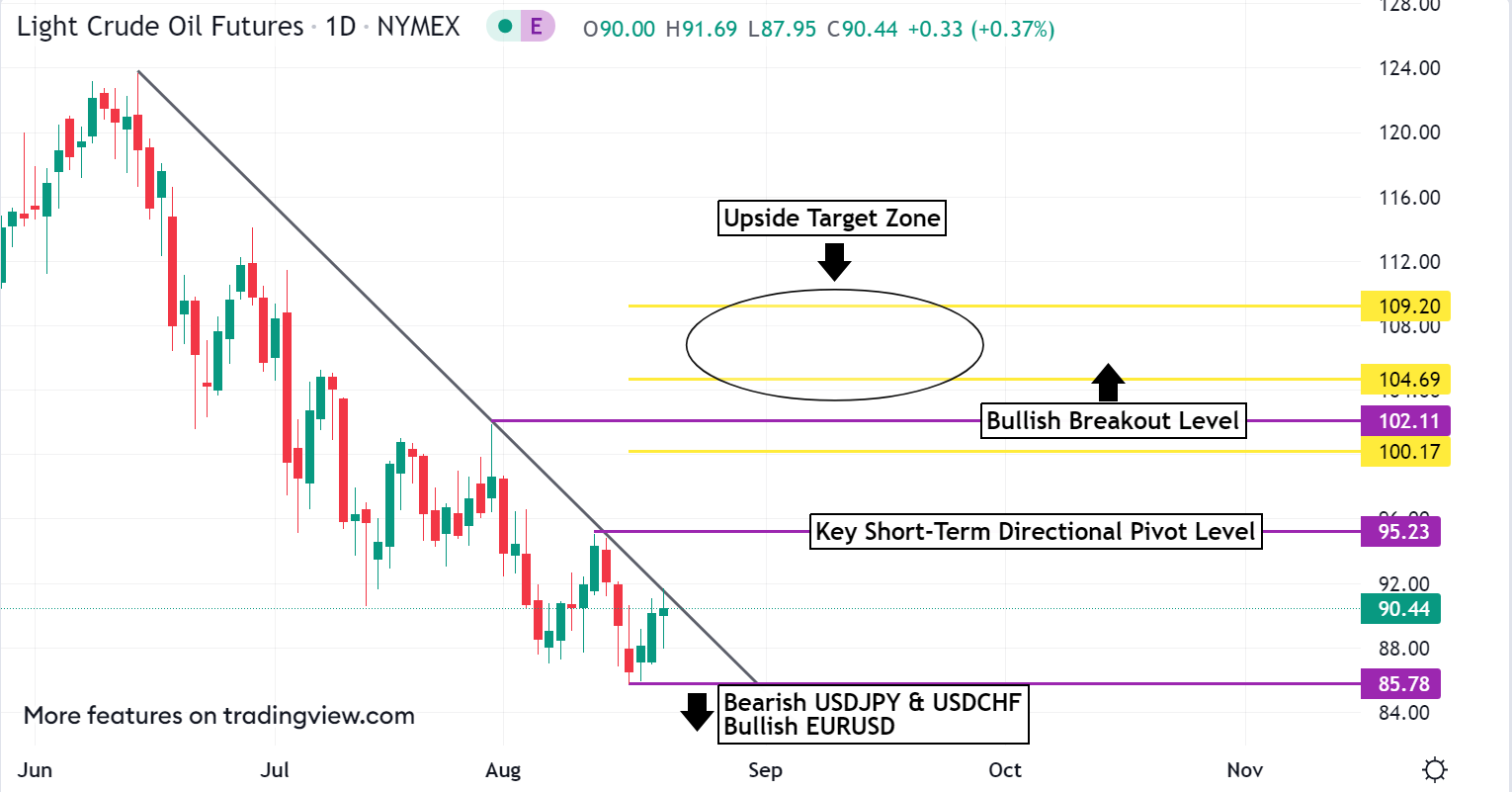

Crude Oil Bear Trend remains intact. A correction is brewing.

30yr T-Bond Long-Term Bear Trend is hammering support.

EURUSD Weekly Outlook :

The upside correction in the EURUSD took a turn hard. Is the long-term Bear trend back? Or, is this Forex pair set for big sideways? An early test of support is anticipated, and parity should be flirted with again. Be careful trying to buy into this current slide. Selling pressure is very likely to build. If there is a print under 0.9950 another fresh wave of selling targets the 0.9822 level.

A short-term bounce this week is not expected to hold up. The forecast is a sell rally one until there is a valid Buy signal. Key support did not hold up last week, and it may be hard to find a base at current levels. Unless there is a move above the 1.0200 level it will be hard to validate any show of strength. Only a close above 1.0368 takes us off of the negative forecast for this Forex pair. This is not likely with a lower trading U.S. interest rate market.

GBPUSD Weekly Outlook :

The GBPUSD fell under pressure of some serious selling at the end of the week. The Bears are hovering just above new move daily lows. With USD strength rearing its head it would be unwise to buy into this market until there is a signal. 1.1757 is the first target to watch out for this week. A failure from this area confirms extended weakness down towards the 1.1588 level.

Only a sustained trade above 1.1757 keeps this market from unraveling again. Any move to the upside is not expected to last, and it is unlikely that a large bounce will occur over the next few sessions. It would take a balloon under water rally to change the current outlook. Trading above 1.2297 would be necessary to confirm a short-term change in trend.

USDCHF Weekly Outlook :

Talk about a bounce. USDCHF Bulls marched higher last week, and another challenge of resistance is expected. It may be a grind higher, but momentum remains in the hands of the Bulls. 0.9653 is the critical resistance level to pierce. If the market gets above here another wave of fresh buying is likely to return. The upside target zone should put a cap on the current rally.

The short-term trend is in control, and it is a buy break outlook. If you are Bearish, it may be wise to wait for a valid signal. Only a slide under 0.9372 takes us off of the Bullish campaign for a fresh leg lower targeting the 0.9166 level.

USDJPY Weekly Outlook:

Boy did we get our challenge of resistance last week in the USDJPY. With the 30yr T-Bond on edge it is likely that this Forex pair will continue the trek higher. If the Bulls get above 139.39 it is likely to spark more momentum to the upside. 140.00 and 141.82 are the upside targets. And watch the Crude Oil market as well. If there is a rally there it may help add fuel to the rally in the USDJPY too.

Until there is a valid sell signal it will be hard to target support. Only a failure from 131.70 takes us out of rally mode, and into a big sideways outlook. 128.38 is the longer-term downside target.

AUDUSD Weekly Outlook :

AUDUSD Bears hit the market hard last week, and the market is hovering above the 0.6850 key directional pivot level. Trading under here should add selling pressure targeting 0.6627 and new move lows.

Sustained trading above 0.6850 puts this market into a big sideways trade up to 0.7140. Only trading above here confirms a longer-term trend change. Unless there is a big rally in the U.S. interest rate market it is unlikely that the Bulls will keep a rally together in the AUDUSD. We need a close above 0.7140 before any extended upside targets will come into play.

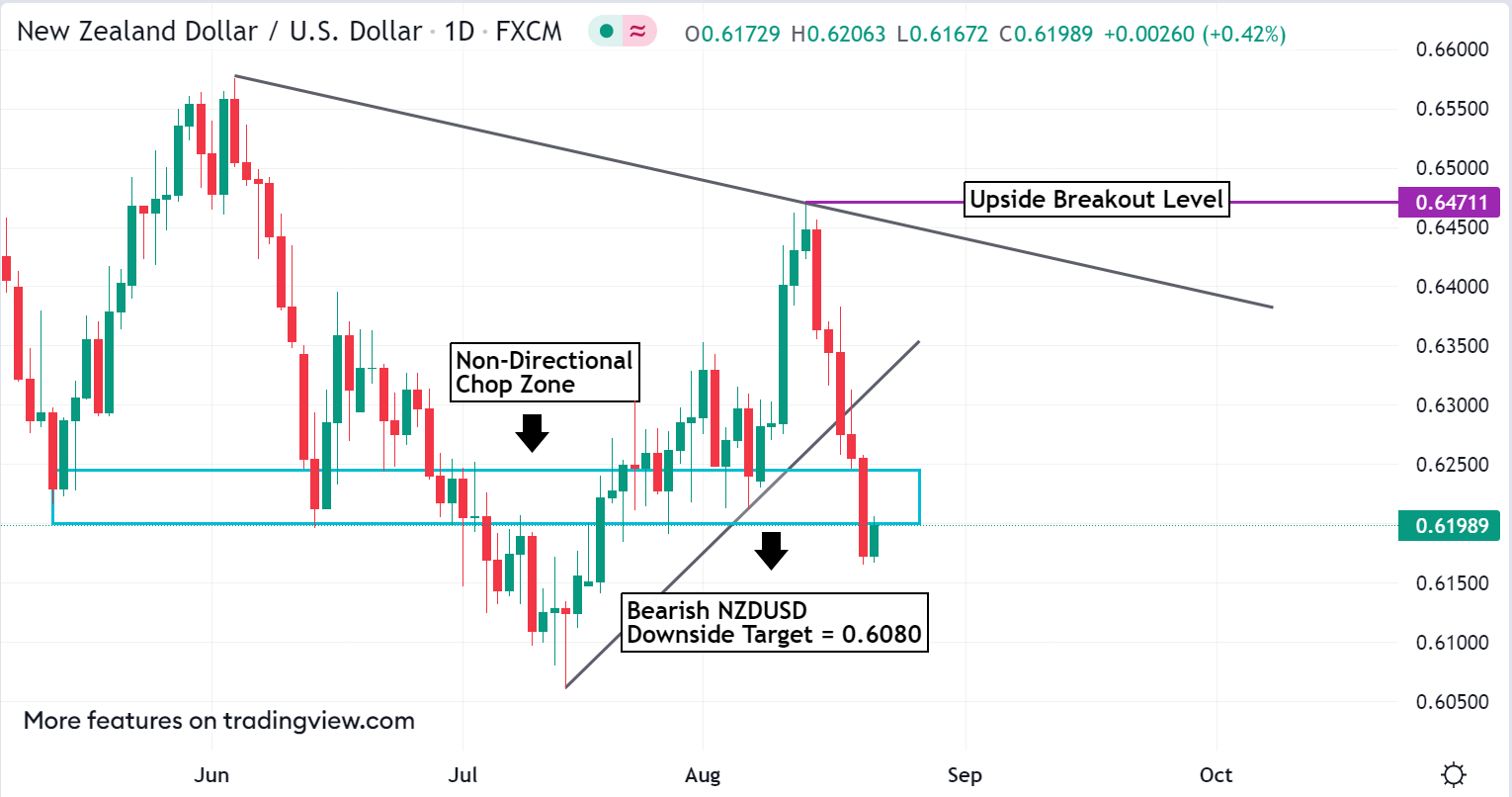

NZDUSD Weekly Outlook :

Bearish momentum slapped the NZDUSD hard last week. More downside action is in the cards this week. Use caution. Trading under the non-directional chop zone keeps this market’s face in the dirt. 0.6080 is the downside target. This is a soft level. If the market is going to stabilize then this level should hold. Trading under here is a negative signal that newer move lows are under way.

If the Bulls can get above 0.6250 then there may be enough fresh buying to spike this market higher. It is a sell rally forecast, and it is unlikely that the market can maintain momentum to the upside. Only a breach of 0.6471 confirms any long-term strength, and a change in trend.

USDCAD Weekly Outlook :

The USDCAD found a short-term bottom, and is trading in our upside target area. If this move is going to fall apart then it is unlikely to get above 1.3034. Be careful. A sustained trade above 1.3034 confirms another show of strength, and a play for 1.3224. Remember this market is set to disappoint. Do not get too Bullish. There are a lot of mixed signals still at work in this Forex pair.

It would take a sustained trade under 1.2980 to confirm a pause in the current show of strength. Not much is likely to the downside, and it will most likely be a sloppy trade down to 1.2730. This is a critical support level. If the market presses new move lows under here then the downside target is extended to the 1.2558 level.