The Tiger Forex Report 8-5-24

The Tiger Forex Report – Week of 8/5 – 8/09/2024

The DXY Took a hit after the FED started to lean towards a rate cut at the next meeting.

Crude Oil Bears are on the move and lower move lows are likely.

30yr T-Bond Bulls went parabolic with the hint of a rate cut in September. This keeps the market in a buy-dip posture for a few weeks.

EURUSD Weekly Outlook:

The Bulls are on the move in the EURUSD and are ready to make a run for higher move highs. A follow-through move to the upside is expected this week. It would be unwise to fight the strength. Upside momentum has the potential to hit the upside target #1 before there is a correction.

All pullbacks will be viewed as profit-taking moves this week. Only a failure from the monthly directional pivot level would reverse the outlook. Trading below here would be a good indication that the market is making a short-term reversal. This sets the Bears up to target the downside correction band.

GBPUSD Weekly Outlook:

GBPUSD traders faced some strong volatility last week, but the market did not stretch extremes like many other FX pairs. The UK is facing a contracting economy which is most likely to blame for this. The downside correction zone is the area to watch for directional bias. Sustained trading below this area should keep the market aimed at lower levels. The monthly directional pivot is the key target.

Sustained trading above the downside correction zone this week would be a positive sign that the Bulls are trying to spark a correction higher and recapture higher levels. The upside correction band is the first target to reach. If the trend is going to be reinforced by a weak USD the upside breakout level should become a key Bullish acceleration area.

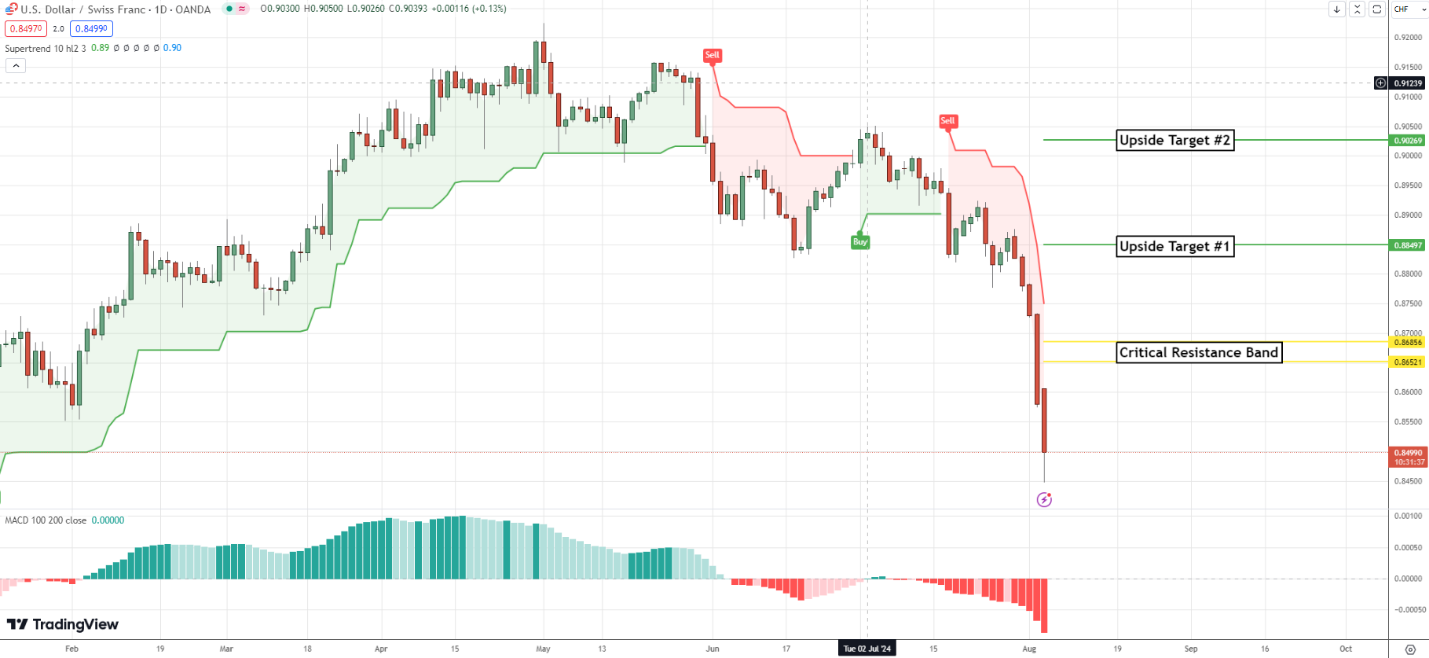

USDCHF Weekly Outlook:

Extreme selling pressure in the USDCHF keeps this currency in the gutter. Below the critical resistance band, the Bears will be in search of a retest of last week’s low. 0.8200 is the sell-off objective. With Yields in retreat, it will be hard to sustain rallies for a while in this market.

Only a close above the critical resistance band confirms the Bulls' resolve to make a correction. Trading above this area should spark fresh buying and lift the market up toward the upside target #1. This is all that is likely from a corrective rally until there is a shift in Yield direction.

USDJPY Weekly Outlook:

The Bears slammed the USDJPY below the monthly directional pivot level. Trading below here keeps the market poised for newer move lows. 140.75 is the downside target. The market will be in a sell rally posture until there is a close above the 150.00 level. 137.80 is the longer-term downside target.

If there is a rally this week it is expected to be a profit-taking move and a short-lived one at best. Only a shift in Yields would change this outlook. This would then make the critical resistance band a viable objective. With the level of volatility in this currency swings like this may very well develop.

AUDUSD Weekly Outlook:

Wow! What a move in the AUDUSD last week. The critical support zone held the market afloat. Another test of this area is likely this week if the trend is solid. 0.6250 is the extended downside target.

If the Bulls can get a close above the upside correction zone a short-term turn may develop. Trading back in this area would be a good sign that the Bulls are going to try and press the AUDUSD up to the monthly directional pivot level. This should be it for a Bullish move as long as Yields are pulling back.

NZDUSD Weekly Outlook:

Quite the spike low in the NZDUSD last week. More lower trading action is likely this week. A dip below the downside target level should build. The extreme downside target level is the big test for this market. A failure from here extends the longer-term downside objective to the 0.5690 level.

There is a chance that the Bulls may get a bounce this week to take some profits off the table. If this occurs the Bulls will have their sights set on the upside correction zone. This is all that is expected from a higher trading market as long as Yields stay in retreat.

USDCAD Weekly Outlook:

We may have seen a spike high in the USDCAD last week. Trading below the upside breakout level has the market set for a pullback. The profit-taking zone is the first stop on a move that could reach the critical support band over the next few weeks. With Yields in the dumps, it would support this outlook.

If the Bulls get a breakout to the upside all bets will be off for the Bears. Upside momentum should build above this area and fuel a fresh leg higher up toward the 1.4120 level. It is unlikely that this will occur until Yields firm back up. It would take a shift in economic numbers towards inflation to make this scenario unfold.