The Tiger Forex Report 9-16-24

The Tiger Forex Report – Week of 9/16– 9/20/2024

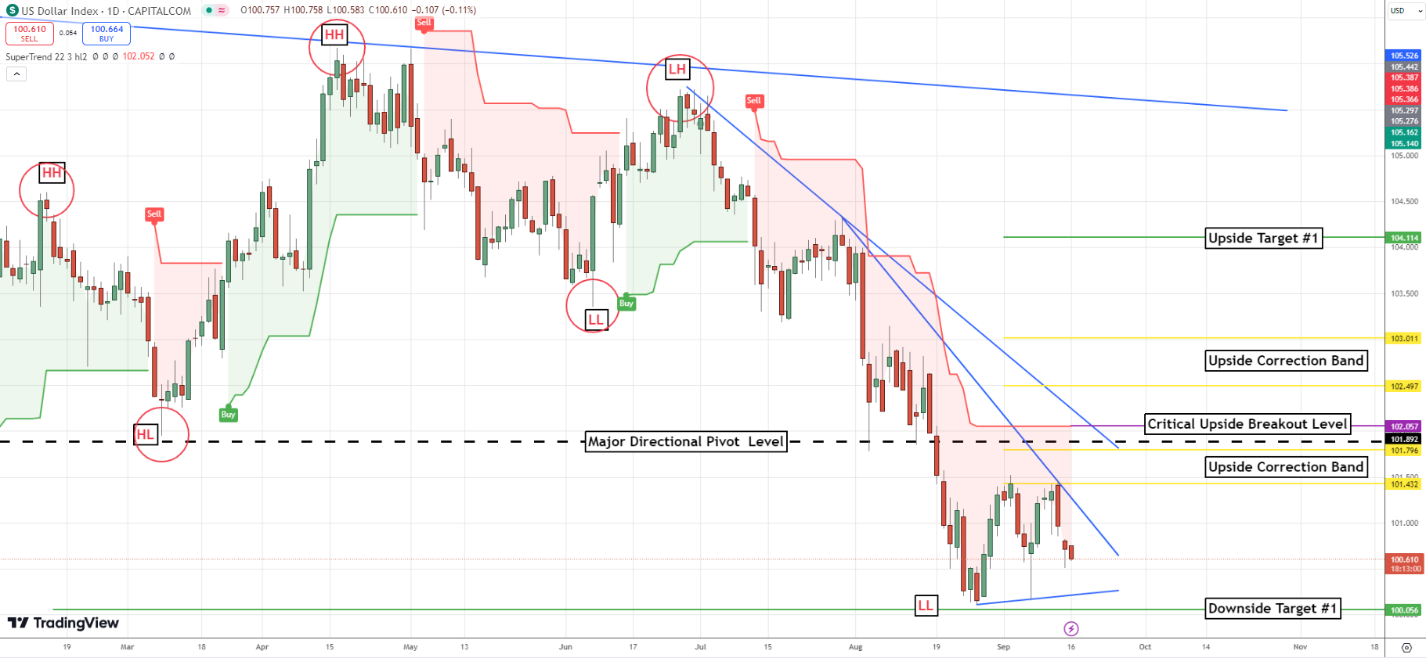

The DXY is stuck in a range trade above the recent lows as the market awaits the FED rate cut.

Crude Oil is in a short-term corrective mode. It is a sell rally forecast until after the FED meeting. Lower Interest rates mean lower cost of carry…fundamentally Bearish.

30yr T-Bond Bulls are banking on a quarter-point rate cut. More than a half is factored in. Better hope for multiple cuts in the FED speak. Otherwise, look for a potential spike high this week.

EURUSD Weekly Outlook:

The EURUSD is ready to press the upside correction band in front of the FED meeting. This should be it until after the release. The ECB has had a couple of cuts. Use caution when getting too Bullish. Unless the message is that there will be more rate cuts to come. A violation of the upside breakout level is a good indication that the market will be targeting the 1.1345 level in the long term.

If the Bears can get some momentum, not much is expected. The downside correction zone is likely to hold firm. Be careful trying to fade this move. Fresh selling pressure is likely in this area and should help to slam new move lows. If there are more than two closes under this area there is a good chance that the GBPUSD could get near the monthly directional pivot level.

GBPUSD Weekly Outlook:

A run at resistance is the call for the GBPUSD this week as the market waits for the FED rate cut. Be careful trying to fade this Bull. If the market takes out the upside breakout level there is likely to be some fresh buying to add to momentum. Trading above here targets the 1.3400 and 1.3480 levels.

The downside correction zone held firm last week, and the low set looks very solid. If the Bears can get a dip below this area to make a lower move low, then the downside breakout level will be the new critical support level to look out for. Trading back in this area would be an indication that the GBPUSD will be back into a range trade mode. The world is watching the elections here, and until afterwards the FX pairs are likely not to set any serious trend moves.

USDCHF Weekly Outlook:

The Bear trend remains intact in the USDCHF. Until after the FED meeting, there is not likely to be any serious swings. A sell rally posture remains, but not much follow-through is likely until after the FED meeting. Be mindful of a range trade until the release. A failure from the downside breakout level is not to be taken lightly this week. The trend is a big Bear, and trading under this area targets the 0.8290-0.8275 support band.

Another challenge of the upside correction zone is not out of the question this week. However, there is not much more expected to the upside. Only a close above the upside breakout level would reverse the short-term outlook for a corrective move that could reach the upside target #1 over the next few weeks.

USDJPY Weekly Outlook:

With Crude Oil on edge and a FED rate cut looming the USDJPY Bears are on the move. It would be a bad decision to try and catch a falling knife here. Continued support bashing is on the menu this week. 138.50 and 137.85 are the downside trend objectives.

If the market pulls back it should be viewed as a profit-taking bounce. Only a big rally in Crude Oil, or FED inaction could change this outlook. The upside correction zone should put a lid on any rally this week. It would take a close above the upside breakout level to confirm any short-term change in trend. The monthly directional pivot level would then be a viable trend objective.

AUDUSD Weekly Outlook:

AUDUSD traders are trying to press the upper boundaries of the big range trade this market has been stuck in. A challenge of the upside breakout level is the call. If there is a close above here then it is likely that the trend will press new move highs all the way toward the 0.6925 and 0.6990 levels.

The trend is very solid in the short term. Most likely if the Bears fall on support the downside correction zone will hold. A close below the downside breakout level would change this outlook. Trading back in this area would be a good indication that the Bears are on a mission for the monthly directional pivot level.

NZDUSD Weekly Outlook:

NZDUSD Bulls are going to most likely make a run at resistance this week. A challenge of the critical resistance band is the call. Be careful trying to fight this rally. A close above the upside breakout level would be a big indication that the market will be on a mission to lift this currency all the way up toward the 0.6420 level.

Only a dip below the downside breakout level will reverse gears for this FX pair. Trading under here would be a negative sign that the market is going to make a run for the critical support band. This is all that is likely for an extreme sell-off in the NZDUSD. With a FED rate cut in the cards, it will be hard to get too much of a sell-off in this market.

USDCAD Weekly Outlook:

USDCAD Bulls are having trouble keeping this corrective move higher going. The critical resistance band is expected to hold back the strongest of Bulls this week. Fundamentals are not there to fuel a big rally this week. It would take a close above the critical resistance band to change the outlook. The upside breakout level would then become a viable objective.

Until after FED day the USDCAD most likely will be in limbo. It would take a breaking market that takes out the recent swing low to confirm any extended weakness. If this occurs the downside correction zone will be the area that the Bears will be looking to hit before there is a bounce.