The Tiger Forex Report 9-9-24

The Tiger Forex Report – Week of 9/9 – 9/13/2024

The DXY is waiting on the CPI and it is likely to cause the index to get volatile this week.

Crude Oil Bears are in control riding new move lows. This market should remain under pressure this week.

30yr T-Bond Bulls are waiting on CPI before spiking to newer move highs.

EURUSD Weekly Outlook:

The trend is a Bull in the EURUSD, but until CPI is released this market may continue to ride the correction lower. A dip into the downside correction zone is expected. If the trend is to continue lower in the short-term the market needs to fall below the downside breakout level. Trading under here targets the monthly directional pivot level.

Another rally into the upside correction zone should help to get the Bulls back on track. If the market gets above this area it should help propel the EURUSD toward the upside breakout level. Be careful fading a rally above this area. 1.1275 is the longer-term upside objective.

GBPUSD Weekly Outlook:

The GBPUSD Bulls are on pause as the profit-taking slide continues. A test of the downside correction zone is the call for early in the week. This area is likely to hold. Trading below here would be a negative indication that the market is ready to lean on the downside breakout level.

If the Bulls can reverse gears and get a rally above the upside breakout level a big move may unfold. New move highs for the trend are expected to catapult this currency up toward the 1.3350 level. 1.3410 is the longer-term rally objective.

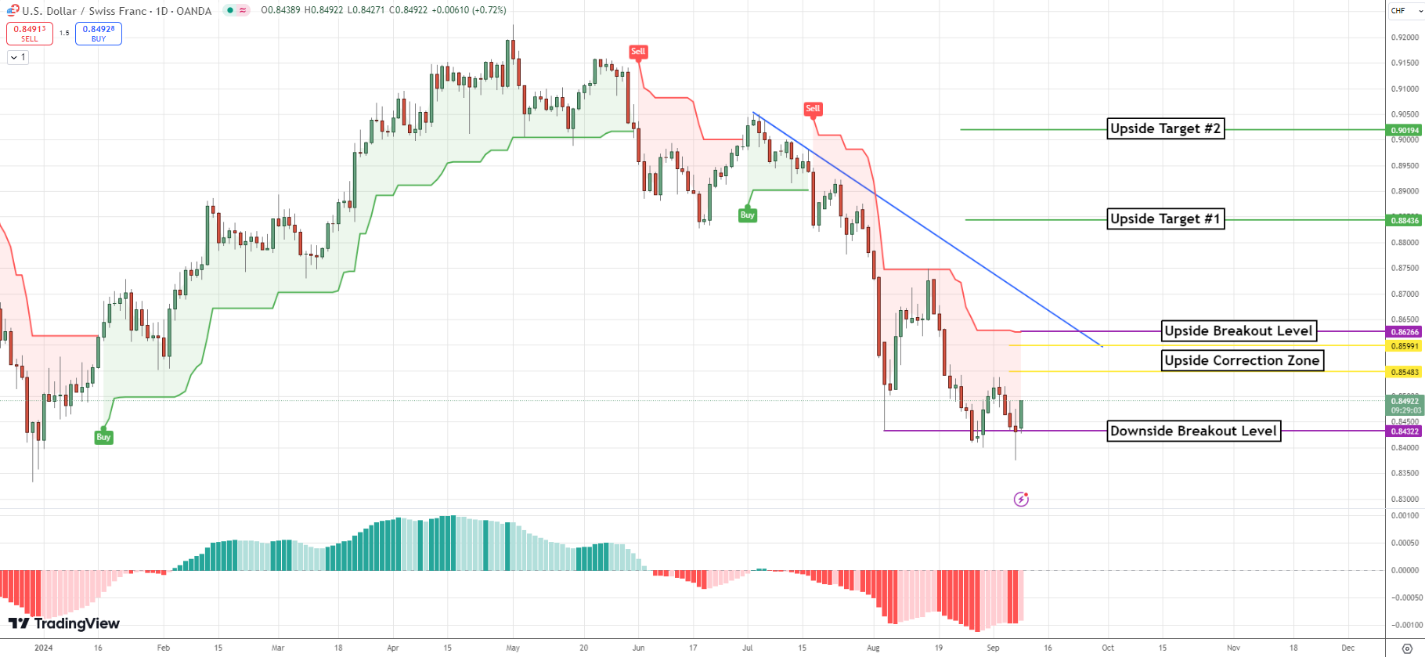

USDCHF Weekly Outlook:

The Swiss planted a newer move low, and the trend remains under pressure. The Bulls may be able to keep control for a few days. A profit-taking rally into the upside correction zone is not out of the question this week. This should put a cap on any upside follow-through. A breach of the upside breakout level, however, changes the outlook. Trading above here would be a positive indication that the Bulls ara going to make a run for the upside target #1.

If the Bears fall below the downside breakout level again it would be a negative indication that the USDCHF is set for a new trend move lower. 0.8250 and 0.8220 are the Bearish targets. If CPI stirs things up this slide could get as low as 0.8140 before there is a bounce. Do not try and catch a falling knife.

USDJPY Weekly Outlook:

This Bear trend is not letting up. Until the CPI number, a bad range trade is likely. Only a failure from the downside breakout level confirms the Bears' resolve. 139.50 and 138.75 are the downside targets. With Crude in the gutter, the USDJPY Bears are getting set to hammer support.

A close above the monthly directional pivot level is needed to reverse the trend. If this occurs it will be viewed as a profit-taking rally. The critical resistance band is the objective. Not much more is likely under the current market conditions. 150.00 is the upside-bullish extreme rally target.

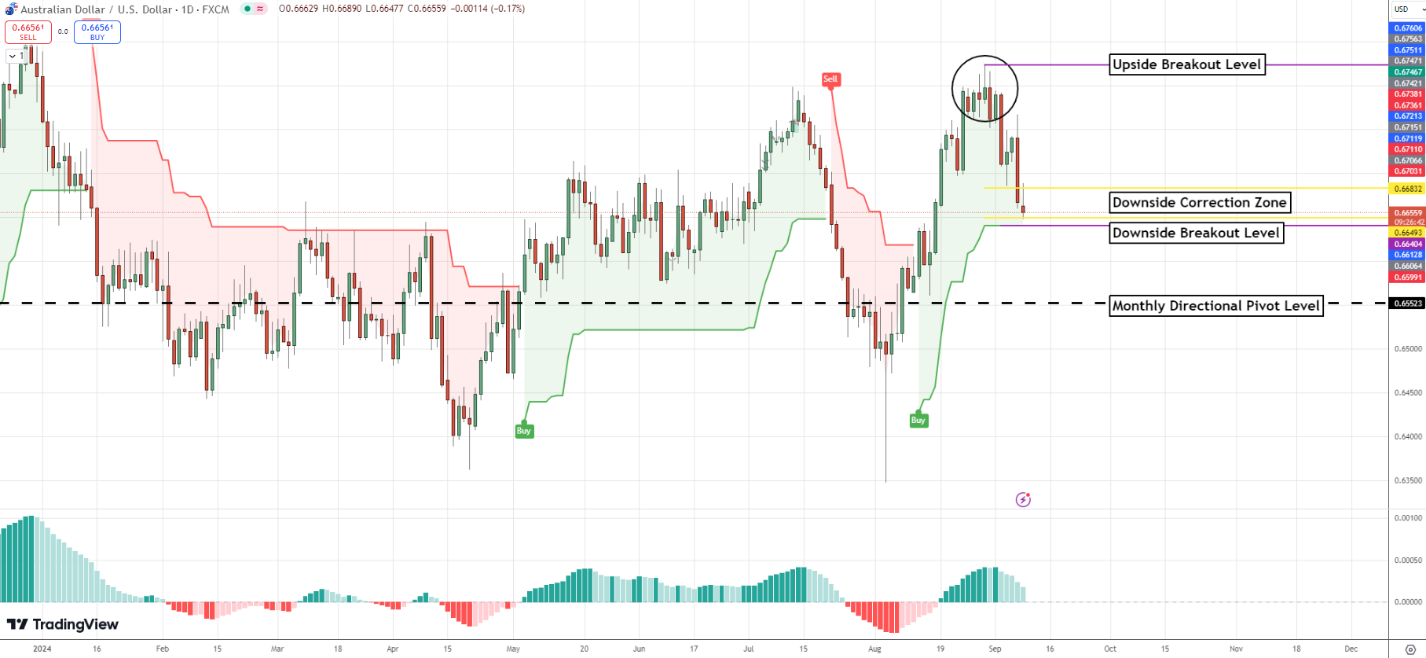

AUDUSD Weekly Outlook:

AUDUSD Bears are on edge. Use caution when trying to fight this slide. If the Bears get below the downside breakout level selling pressure is likely to build. Look out below. The monthly directional pivot level then becomes a very viable objective.

Trading above the downside correction puts the market on hold for a digestive trade. Only a rally above the upside breakout level would change the outlook for this currency. 0.6850 is the long-term rally target. Fundamentals are not lining up for a move this big, but who knows if CPI could come out of line. We shall see how the number impacts the trend this week.

NZDUSD Weekly Outlook:

NZDUSD is on edge. If the market gets under the critical support band it would be a good sign that the Bears will be on a mission for the downside breakout level. If we get below here there will be an update.

If the Bulls can catch a strong bid and get above the upside breakout level do not fight the move. Trading back in this area would be a good indication that the market is set to rally big. This puts the upside target level into the Bulls' sights. If the market gets back into this upper band it would be unwise to try and fade the trend.

USDCAD Weekly Outlook:

USDCAD Bulls are looking to make a run at the critical resistance band. Be careful if the market reaches this area. A touch-and-go trade is expected here. Trading above this area should give the correction some more gas and give the Bulls a shot at the upside breakout level. This leaves the upside target #1 a viable trend objective then.

If the Bears fall back on support and make a lower move low selling pressure is expected to build. The downside correction band will then be the area the Bears will be looking to reach. If the market gets down in this area there will be an update.