Tiger Forex Report 11-27-23

The Tiger Forex Report – Week of 11/27 – 12/01/2023

DXY Bears are maintaining the trend lower. There is a Sell signal in the 30yr that may put a halt to the soft USD. Watch Yields this week closely.

Crude Oil is hovering around the critical directional pivot level. Key of this area for directional bias.

30yr T-Bond Futures touched off a sell signal on Friday. A short-term slide in the market is very possible this week.

EURUSD Weekly Outlook:

EURUSD Bulls are on a mission to hit the upside target level. Momentum is on their side, and an early test of this area is on the menu. Use caution with Longs this week though. There is a sell signal in the 30yr that could turn this market around fast. Keep your Stops tight if you are a Bull. This currency remains strong above the daily directional pivot level. Trading below this area is a good indication that the Bears are trying to regain control of the market. If Yields are going up it would be unwise to fight a lower trading EURUSD. Downside momentum is expected to grow. The critical support band is the first area to shoot for a soft landing. But this is not a buying area. It is a support area. A break under 1.0646 should keep downside momentum fueled up for a move that targets the downside breakout level.

Above the daily directional pivot level, the EURUSD should maintain a Bullish posture up to the upside target level. This should be the cap for the current rally. Only a close above 1.1029 confirms any extended strength. 1.1150 is the longer-term Bullish objective.

GBPUSD Weekly Outlook:

The GBPUSD is pressing the trend upward. Use the daily directional pivot level for the market’s bias. Trading above here should spark a rally up to the upside correction target level. This is all that should happen in the short run. Fundamentals are poor, and Yields are expected to go higher this week. 1.2985 is the long-term upside target if the USD gets a big sell off.

Trading below 1.2594 sets the market up for a digestive phase. A sell off into the critical support band would be a nice move after the long Bull run that the GBPUSD has had the past two months. This is all that is likely if the market is trying to bottom. Trading under 1.2260 is a good sign that this currency will be testing the downside breakout level. With Yields expected to rally this week it would fit this scenario very well.

USDCHF Weekly Outlook:

USDCHF Bears are trying to press the Bearish correction further. Watch Yields. If they are going up it will be hard for the Swissie to get much lower. In fact, a corrective rally is likely. The upside correction zone is the key target area. If this market is truly turning there should not be any trading above here. A breach of 0.9079 would be a good indication that the Bulls are ready to make a play for extended upside target.

Sustained trading under the 0.8814 level is a sign that the USDCHF is set to continue lower. The downside target level is the objective. This should be it unless Yields start to pull back again sharply. 0.8528 is the extended downside target level to shoot for.

USDJPY Weekly Outlook:

There has been a nice correction in the USDJPY, and the market is holding below the key 150.00 level. Watch the DXY this week. If USD strength returns it should lift this FX pair higher again. Trading above the 150.00 level targets the upside breakout level. 153.68 is the extended rally target.

If Yields do not go higher this week, then the USDJPY is very likely to fall back into the critical support band. Only a failure from the 147.15 level confirms weakness and the markets resolve to trade lower. 145.09 is the first stop on a break that could hit the downside correction zone.

AUDUSD Weekly Outlook:

The Aussie Bulls are pressing the upside correction zone, and an early challenge of this area is likely this week. There is a sell signal in the 30yr, and that may put a stop to the Bullish advance in this currency. A sustained trade above 0.6579 should keep the Bulls aimed at the 0.6657 level. This is a key area to cross. If the Bulls get above here there is a good chance that the market could reach the extended upside target.

AUDUSD Bears may get some help from a stronger USD this week. If Yields rally this FX pair has the potential to have a nice sell off. A pull back to the critical support band is likely. This is it if the market is truly trying to turn. Trading under 0.6392 should have the market pressing the downside breakout level in a heartbeat. Do not try and fight a break into this area. New monthly lows target the 0.6175-0.6169 support band.

NZDUSD Weekly Outlook:

The Bullish trend continues in the NZDUSD. Fundamentals are very bad for this market and it is likely that we are pushing the upper end of a wide range trade. There is a Sell signal in the 30yr that could turn this currency around fast. If the market gets above 0.6093 there is a good chance for a spike high up towards the extended upside target. This is all that is expected for Bullish action this week. Unless Yields get a big pull back and negate the sell signal.

Sustained trading below the upside correction zone this week would be a good indication that the NZDUSD is ready to test support and fall back into the range of the last few months. It may get very choppy and swing trading may get tough. If Yields start to rally it is likely that this currency will pull back to the critical correction support band. This is it if the market is really trying to turn things around. Trading under this area should flirt with the downside breakout level, and the potential for new multi month lows.

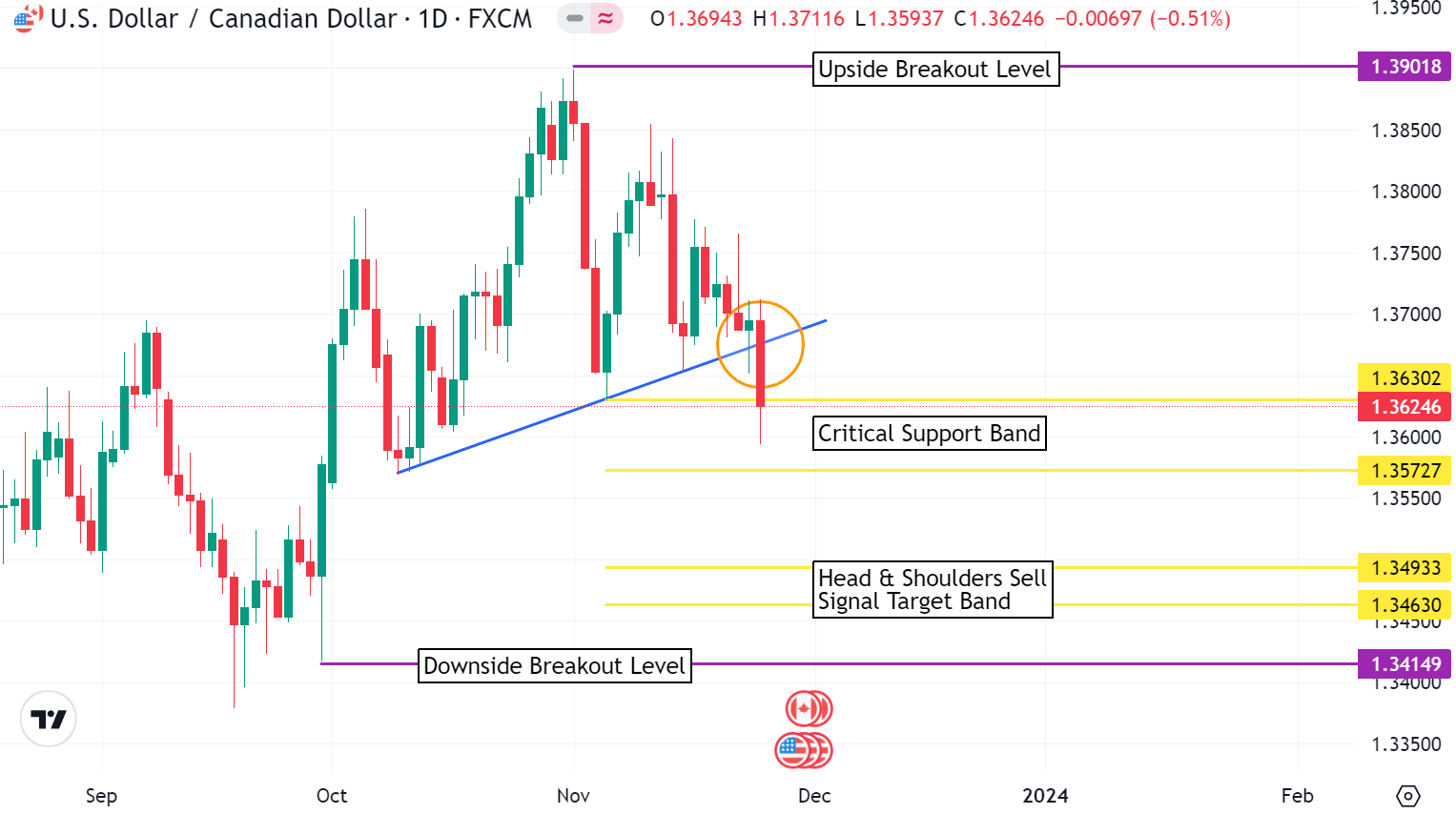

USDCAD Weekly Outlook:

USDCAD Bears spiked new move lows into the critical support band on Friday while confirming a Head & Shoulders Sell pattern. Because of this there is more selling action expected this week. A failure from the 1.3572 level will keep this currency on edge looking to press the slide all the way into the Head & Shoulders Sell signal target band. With the Sell signal in the 30yr it is not likely that the market will fall much beyond this area.

Trading above the critical support band is needed to confirm strength. If this should develop the USDCAD will be in a tough trade to climb higher. Unless Yields get a big boost. If this unfolds the Bulls may start a very strong rally up towards the upside breakout level. Do not underestimate the USD Bull trend that is still in place. It may resurface with a vengeance before the year is out. 1.4022 is the longer-term Bullish target level.