Tiger Forex Report 8-12-24

The Tiger Forex Report – Week of 8/12 – 8/16/2024

The DXY remains under pressure, and it may be a week of consolidation trading.

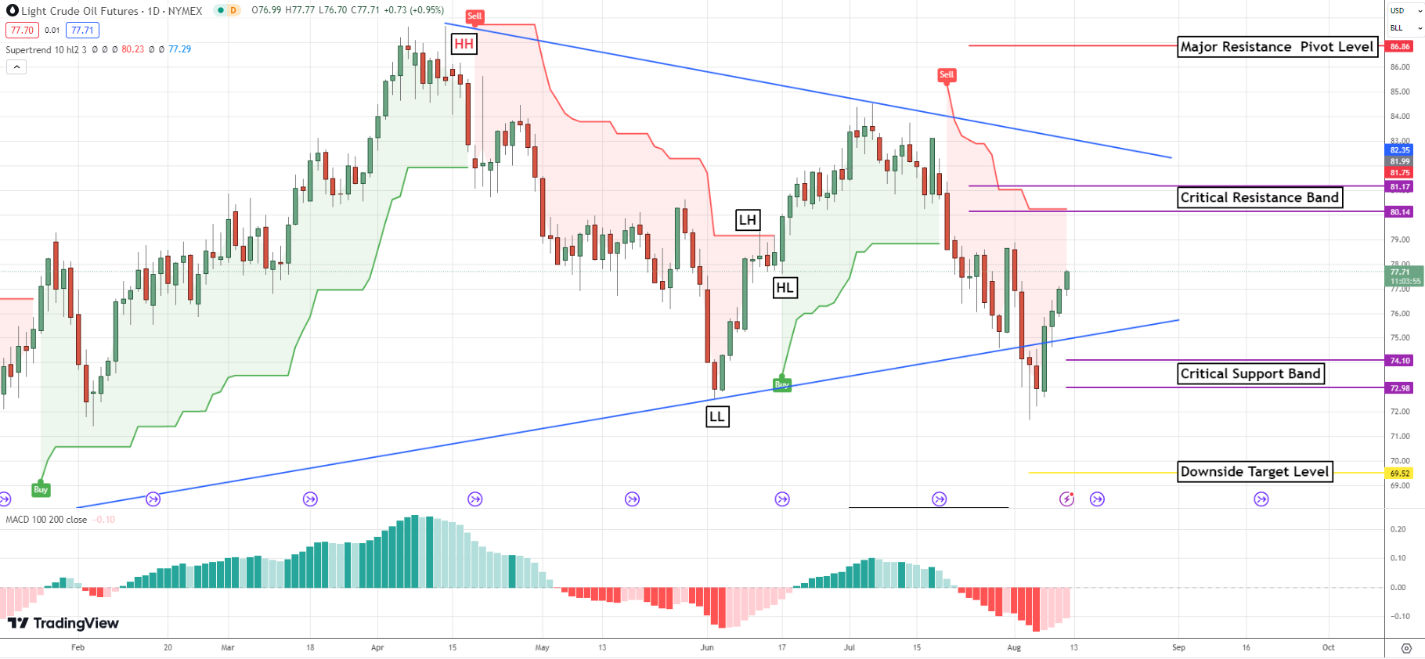

Crude Oil Bulls are on the move and they are looking for more upside follow-through this week.

The 30yr T-Bond is swinging around and has bounced off strong support. More downward pressure on Yields is expected.

EURUSD Weekly Outlook:

The EURUSD has begun to stabilize, and more sideways trading is the call for early this week. An attempt for higher levels should be expected. Also, a run at the critical resistance band should occur this week. Use caution back in this area. Trading in this zone is likely to get choppy. Remember that this currency cross is in a big range trade. 1.1082 is the extended upside objective.

If the Bears take control, it will be a grind down to the monthly directional pivot level. This is a big area keeping the upper range for this currency intact. A failure in this area would be a good indication that the market is on a mission to hit the downside correction zone.

GBPUSD Weekly Outlook:

Trading the GBPUSD is a grind as the Bears try and hold the trend intact. An early challenge of the critical resistance band is expected. If the market can get a close above this area it would be a good sign that the market is ready for a Bullish leg higher. The upside correction band would then become a viable trend objective.

If the GBPUSD falls below last week’s low the Bears will be back in business. Trading below here should spark fresh selling pressure to pound through support. This puts the monthly directional pivot level in focus. If the downside trend is going to be tested it will be in this area. If the market does not bounce here it would signal new multi-month lows that could press the downside target #1 level.

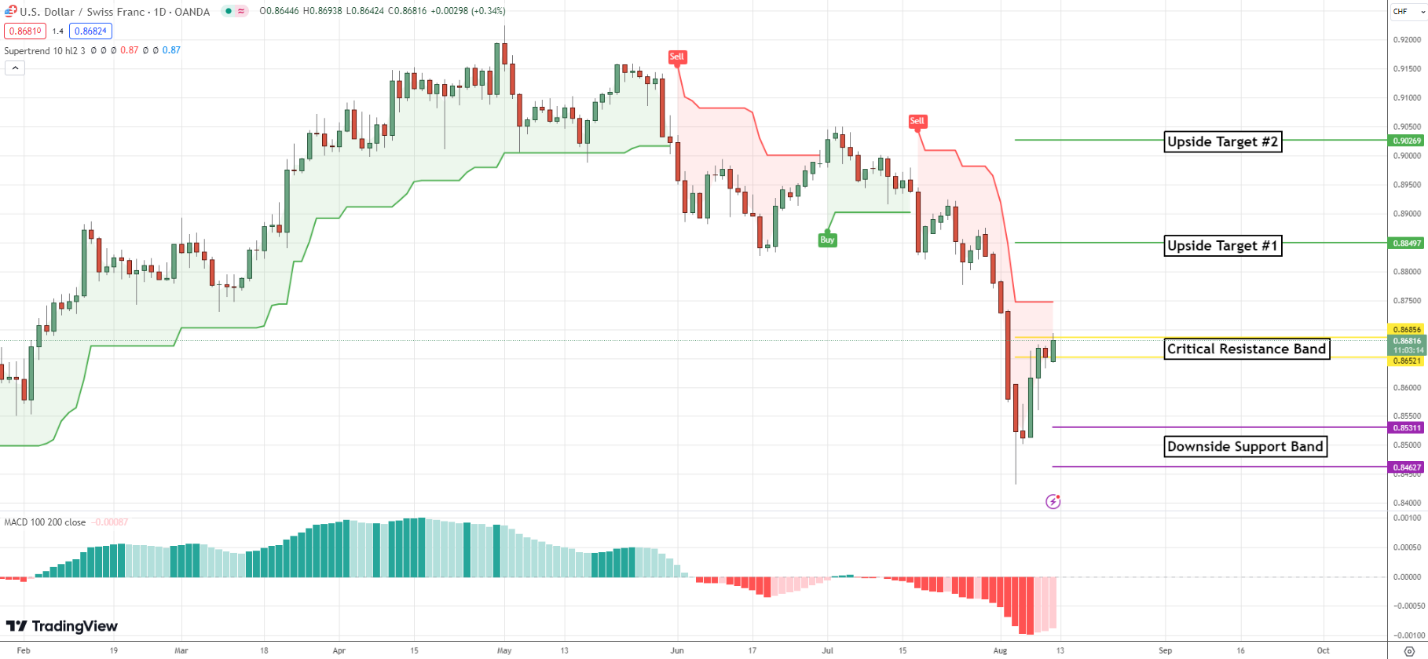

USDCHF Weekly Outlook:

The USDCHF is butting up against the critical resistance band. This area will be the test. If the market can sustain a trade above there it is likely that the Bulls will make a play for the upside target #1 level. If this occurs it should be viewed as a corrective rally. With Yields in retreat, it is very unlikely that the Bulls will get above this area.

If the critical resistance band holds it would be a sign that downside momentum is going to press the trend back to the downside support band. Be careful in this area. If the market falls back to these levels it would be a good indication that the market will press new move lows towards the 0.8300 level.

USDJPY Weekly Outlook:

This is one currency pair that is trying to digest recent market activity. The upside correction zone is the key area to breach. Only a rally above here signals a fresh show of strength and the market's intentions to challenge the critical BOJ threshold level. If the market get a close above this level the Bulls should be able to keep pressing a profit-taking correction up towards the 153.54 level.

Sustained trading under the upside correction zone should keep the Bears in control of the trend and make another run for the monthly directional pivot level. This is a key level. If the market falls below here, the Bears are likely to slam the market to new lows that target the 140.50 level.

AUDUSD Weekly Outlook:

Back to the middle of the range. The AUDUSD has been in a long-term range trade, and more of the same is on the agenda. Above the monthly directional pivot level the Bulls will be fighting to make a run at the upside target #1. Do not get too confident if the market can get a close above this level. This currency is a dog with fleas, and not much is likely to the upside even if the DXY takes a nosedive.

If the Bears get a dip below the monthly directional pivot level the market should make a play for the downside support zone. Be careful at these lower levels. It is expected that the AUDUSD will try and spike a low below this area, but it will likely be just that… A spike. Only a failure from the critical support zone would confirm new lows that target the 0.6275 level.

The NZDUSD Weekly Outlook:

The Bulls are pressing the upside correction zone and most likely will try and get a move above here. Trading above 0.6041 would be a good sign that the market is going to press this correction to the extreme. This makes the critical resistance band a viable target over the next couple of weeks.

Below the upside correction zone, the NZDUSD will be in a digestive trade back to the critical support band. If the market is going to get a bounce it should occur in this area. Trading below here should not be taken lightly. The downside target level is the first stop on a move that could reach the extreme downside target level before the week is out.

USDCAD Weekly Outlook:

USDCAD Bears are on a mission to press new move lows. The critical support band is very likely to be tested this week. This is a key area holding the trend intact. Trading under this area would be a negative signal that the market is going to keep pressing the Bearish trend toward the downside target level.

The profit-taking zone was supposed to hold the market up if the current slide is just a correction. If the market can get back above this area then a rally into the critical resistance band should unfold. This will be a key area for the market to cross. A breach of this area would be a positive sign that the Bulls are back in control and are going to make a play for the upside breakout level.