Tiger Forex Report 9-3-24

The Tiger Forex Report – Week of 9/3 – 9/6/2024

The DXY is making a run at the upside correction band this week, and that is just below the monthly directional pivot level.

Crude Oil is range-bound and more of the same is the call for this week.

30yr T-Bond is in limbo, and the market is likely to be a tough trade until FED time this month.

EURUSD Weekly Outlook:

EURUSD Bears have started the week skimming the downside correction zone. Another leg lower is expected, but do not get too excited. A bounce is likely and a range trade into the upcoming FED meeting is the call. The upside correction band will most likely contain any bounce.

If the market falls below the downside correction zone, then the downside breakout level will be in the Bears’ focus. If the market falls below here there will be an update. The EURUSD is coming off a new higher move high, and there is a long way to go before there is a lower move low…if at all unless there is a rate hike. However, there is rioting throughout Germany, and this could send this currency into free fall if instability continues to build.

GBPUSD Weekly Outlook:

GBPUSD Bears are starting the week trying to break the steep slope. An extended leg lower that targets the downside correction zone is the call. This should put a floor on a corrective sell-off. If the market falls below here it would be a good indication that the market is on a mission to hit the downside breakout level. With the FED meeting ahead, it is not likely that the correction will get out of hand.

Only a rally above the upside breakout level reverses the outlook and confirms the longer-term trend is back in full force. However, until after a rate cut by the FED it is not likely to occur. Do not be surprised if this FX pair slips into range trade mode.

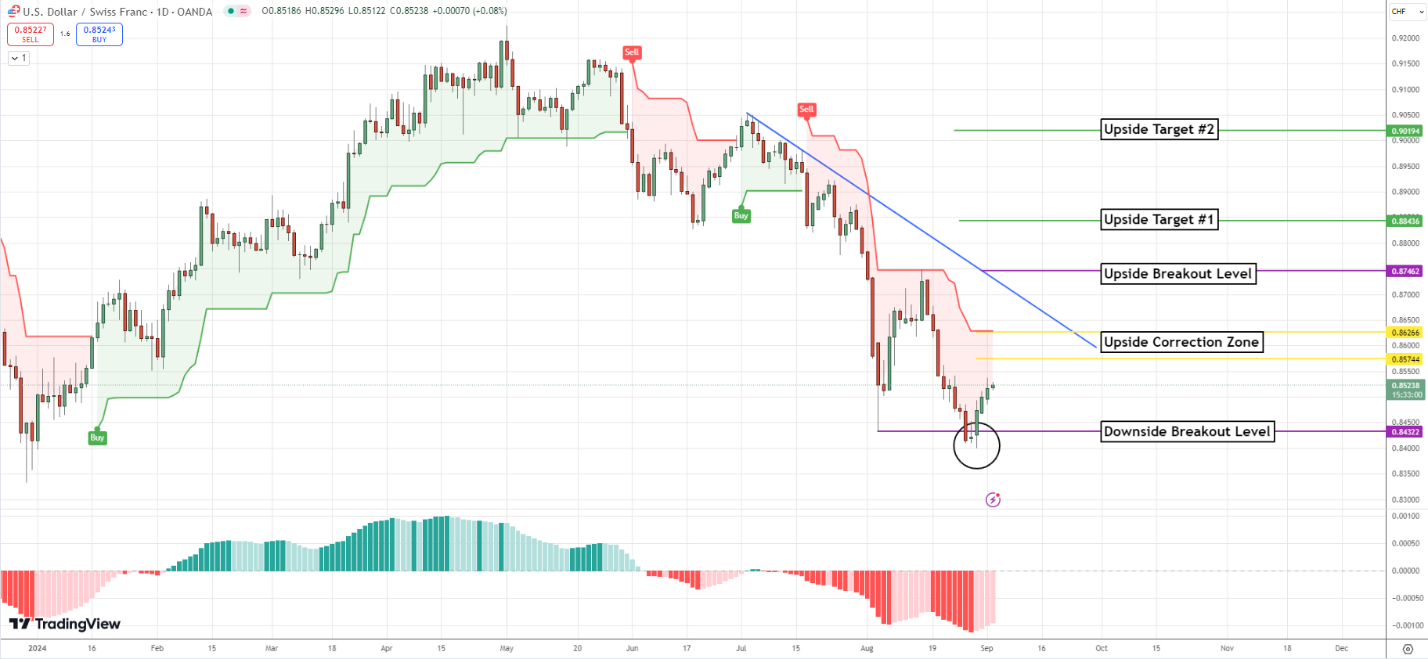

USDCHF Weekly Outlook:

The USDCHF bounced off the downside breakout level and looks like it is in corrective mode. A challenge of the upside correction zone is the first thing on the agenda this week. This should stop the Bulls from taking more profits. In the event that the market closes above this area, the upside breakout level becomes a very strong objective. The FED meeting may hold this currency at bay though.

The BEARS’ are salivating on this one. A rate cut by the FED is just the fuel that is needed to send this currency cross in a serious careening fashion. Look out below is the call. The 0.8220 level is the rate-cut sell-off objective. Until then… do not be surprised to see a flatline range trade develop. It is quarter end soon too. A fun month ahead.

USDJPY Weekly Outlook:

The USDJPY has set a higher move low after a lower move high. Some might think it is Bullish. With a flat Crude Oil market, flat interest rate market, and a FED meeting ahead, guess what? Probably, a slopy range trade ahead. Only a rally above 150.00 gets us Bullish for a fresh trend move higher, and this is not likely to occur.

If the Bears can get below the downside breakout level, then we have something to look for. Trading under this area targets the 137.50 level on a major slide that could see the 135.00 level. This would make the BOJ a bit more comfortable with things.

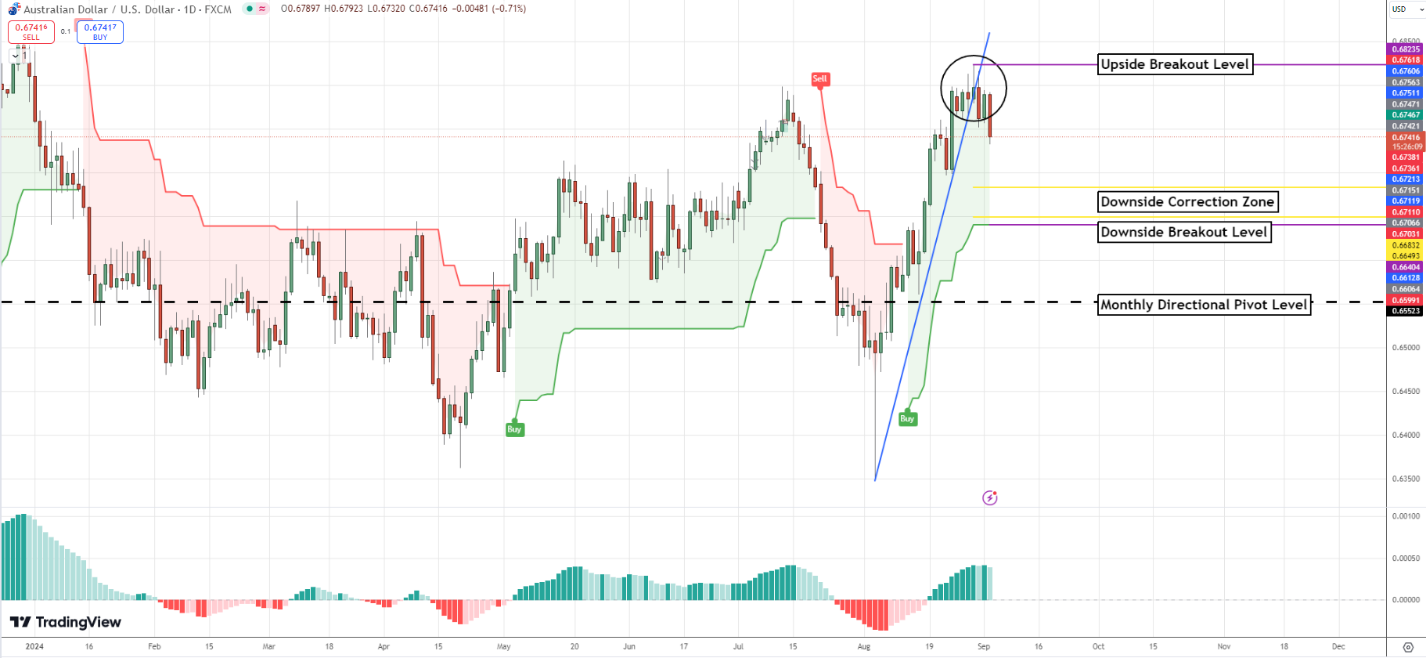

AUDUSD Weekly Outlook:

AUDUSD traders helped lift this market to a higher move high last week, but this week is starting with a profit-taking slide. A pull back into the downside correction zone is in the cards this week, but this should be it for the Bears. With the looming FED meeting do not look for much follow-through over the next couple of weeks. Only a failure from the downside breakout level would change the outlook and extend the downside objective to the monthly directional pivot level.

This market is in a Bull trend but is not likely to make new highs for a while. A rally above the upside breakout level is necessary to confirm that the AUDUSD is set to extend higher move highs up toward the 0.6400 level. 0.6550 is the longer-term rally target.

NZDUSD Weekly Outlook:

The current Bullish trend is riding a steep slope, but this week a profit-taking break is in motion. This pull-back should be viewed as a correction. Fundamentals and a FED meeting lurking in the shadows should keep this FX pair from freefalling. It is expected that the critical support band will set a floor for this correction. If the market falls below the downside breakout level there will be an update.

The Bulls are going to have a tough time reversing gears for this currency this week. However, if the market can get a close above the upside breakout level the trend will be back in motion. The upside target level is the first stop on a move that could hit 0.6500 later this month.

USDCAD Weekly Outlook:

Short-term USD strength is helping the USDCAD Bulls get a profit-taking rally in motion. In the short-term the market is expected to hit the critical resistance band. Be careful in this area. A touch-and-go trade is expected in this area. Only a rally above the upside breakout would negate the sell rally forecast. Trading above here should have the Bulls aiming for the upside target #1.

The USDCAD has set a lower move low and is set for a profit-taking rally. The market is breaking the steep downward slope, but keep your Stops tight. A failure from last week’s low would be a negative indication that the Bears area set to slam new move lows into the downside correction band. Fundamentals are setting the stage for a continuation of the downtrend.